Telefile Tax Record And Instructions - Georgia Department Of Revenue - 2000 Page 7

ADVERTISEMENT

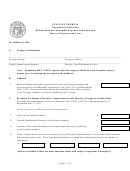

Georgia Form 500-T Individual Income

TeleFile Tax Record Guidelines

W2 Information -

Make sure you have all W-2s from

Line G, Amount of Your Refund -

TeleFile computes

all jobs you had in 2000. During the call, TeleFile asks

and tells you the amount of your refund, if any. Your

you for the amount of state tax withheld (Box 18 on Form

refund is mailed to you at the address on your Federal

W-2) and the Employer’s state ID number (Box 16 on

tax record; or you can have it deposited directly into your

Form W-2). You need to round all money amounts to

bank or credit union account.

the nearest whole dollar. For an example of a W-2, see

page 6 of this Georgia TeleFile Booklet.

Line H, Amount You Owe -

TeleFile computes and tells

Note: If you have more than one W-2, enter information

you the amount you owe, if any. If your return results in

from one W-2 at a time. TeleFile accepts up to 10 W-2s.

a balance due, submit your payment using Form

525-TV. You must pay the amount you owe by

Direct Deposit of Refund -

You can choose to have

April 16, 2001.

your refund deposited directly into your bank or credit

Write your Social Security number and “GA Income

union account. Complete Line A if you did not have Di-

Tax 2000 TeleFile” on your check.

rect Deposit on the Federal return. If this information is

not correct, the direct deposit request is rejected and a

Enter Confirmation Number -

Stay on the line until you

check is issued and mailed to you.

get your TeleFile Confirmation Number. This number is a

record of your return being filed. If you hang up before

Routing Transit Number (RTN) -

The RTN must

you receive the confirmation number or TeleFile tells you

contain nine digits and begin with the numbers 01

that you cannot file by phone, you must complete and

through 12 or 21 through 32.

file a paper return, Form 500 EZ.

Depositor Account Number (DAN) -

The DAN can

Keep this Form 500-T for your tax records.

DO NOT MAIL!

contain up to 17 alphanumeric characters including

Amended Returns -

If you made a mistake on your

hyphens. Omit spaces and special characters. Leave

TeleFile return, you must file Form 500X, Amended

any unused boxes blank.

Georgia Individual Income Tax return, to make the

necessary corrections.

Lines B through E

-Do not complete these lines until

you are on the telephone with TeleFile. TeleFile

computes these line items and tells you what amounts

to write on Lines B through E.

The phone number is on the Federal TeleFile Tax record

that you received from the IRS.

(Be sure to complete

the top half of your Federal Tax Record before

calling.)

Line F 1-3, Contributions -

Any amounts contributed to

these funds decrease the amount of your refund. For a

description of each fund, see the section

“Can I make

on

page 3

of this booklet.

Contributions?”

-7-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12