Telefile Tax Record And Instructions - Georgia Department Of Revenue - 2000 Page 6

ADVERTISEMENT

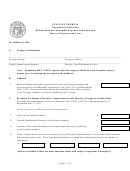

Georgia W-2 Information

TeleFile will ask you to enter the Employer's state ID number (Box 16) and the Georgia tax withheld (Box 18) for each

W-2.

•

The seven-digit Employer's state ID number is usually

The Georgia tax withheld is usually found in Box 18

•

found in Box 16 of your W-2. Only enter the first five num-

of your W-2. All amounts should be rounded to the

bers, ignoring the last two numbers and two letters of the

nearest dollar; for example, $1.51 would be $2.00

Georgia Withholding Number. The state abbreviation in

and $1.49 would be $1.00.

Box 16 should be "GA."

For Official Use Only Ü

a Control number

Void

22222

OMB No. 1545-0008

b Employer's identification number

1 Wages, tips, other compensation

2 Federal income tax withheld

c Employer's name, address, and ZIP Code

3 Social Security wages

4 Social Security tax withheld

5 Medicare wages and tips

6 Medicare tax withheld

7 Social Security tips

8 Allocated tips

d Employee's Social Security number

9 Advance EIC payment

10 Dependent care benefits

e Employee's name, address and ZIP code

11

Nonqualified plans

12

Benefits included in Box 1

13

14 Other

S t a t u t o r y

D e c e a s e d

Pension

L e g a l

D e f e r r e d

15

Employee

P l a n

R e p .

Compensation

16

Employer's GA Withholding Acct.No.

17

GA wages, tips. etc

.

18

GA Income tax

19

Locality name

G A

20

21

Local wages, tips, etc.

Local income tax

Department of the Treasury—Internal Revenue Service

Wage and Tax

2000

W - 2

Statement

Copy 2 To Be Filed With Employee’s Georgia Individual Income Tax Return

-6-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12