Telefile Tax Record And Instructions - Georgia Department Of Revenue - 2000 Page 5

ADVERTISEMENT

Keep This Document For Your Tax Records. Do Not Mail!

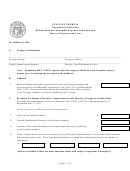

500-T

GEORGIA INDIVIDUAL INCOME

2000

State of Georgia

TELEFILE TAX RECORD

Department of Revenue

You must complete the top

portion of the Federal TeleFile

record and Line A of this tax

record BEFORE calling the

number on your Federal

TeleFile Tax Record.

Direct Deposit Information (Optional, see instructions page 4.)

Expecting a

Checking

Savings

Type of Account:

refund?

Use Direct

Deposit

Routing Transit Number

Depositor Account Number

A .

TeleFile will ask for the amount of state tax withheld (Box 18 on Form W-2) and the

Make sure you have all your W-2s.

Employer's state ID number (Box 16 on Form W-2) for each W-2.

ä TeleFile will tell you the following amounts during the call. Please write them in the spaces below

.

Georgia Adjusted Gross Income (This is the same as your

B.

federal adjusted gross income.) ............................................................................................

During the

call, enter

C.

Taxable Income .....................................................................................................................

the amounts

reported

D.

Income Tax Liability (STATE TAX) .........................................................................................

by TeleFile

E.

Overpayment ........................................................................................................................

F.

Contributions (only if you have an overpayment)

You may

1.

Georgia Wildlife Conservation Fund.............................................................

contribute

all or a

2. Children and Elderly Fund............................................................................

portion of

your refund

3. Georgia Cancer Research Fund ......................................................................................

Do not

G. Amount of Your Refund ........................................................................................................

mail this

Tax Record

H. Amount You Owe ..................................................................................................................

Important: You will be required to make the following declaration:

Under penalties of perjury, I declare that to the best of my knowledge and belief, the return information I provided is true and correct, and includes

all amounts and sources of income I received during the tax year.

Confirmation

Wait for the

Date of Call

Number

/

/ 2001

Confirmation

Number before you

Keep This Document For Your Tax Records. Do Not Mail!

hang up. Write it

down here.

-5-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12