Telefile Tax Record And Instructions - Georgia Department Of Revenue - 2000 Page 8

ADVERTISEMENT

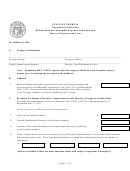

Frequently Asked Questions & Answers about TeleFIle

If I have not filed my return, what is the fastest way to get my refund?

Electronic filing or TeleFiling are the fastest ways.

How long will it take to process my refund?

The earlier you TeleFile your tax return, the quicker you will receive your refund.

Please allow approximately 21 days to receive your refund before inquiring.

How do I check on the status of my refund?

If your refund has not been received within approximately 21 days and you live in the

Metro Atlanta dialing area, you can call (404) 656-6286. If you live in Georgia,

but outside the Atlanta dialing area, you can call 1-800-338-2389.

What if I make a mistake or the system won’t let me TeleFile?

Go to page 9 for more information. You can also call 404-656-4293

or go to our website at to obtain

a Form 500 or 500EZ.

Do I need to mail in a copy of my completed Federal or Georgia return?

No.

What should I do if I forgot to include payment with my payment voucher?

Write your social security number and the tax year on your check or

money order and send it to:

Georgia Department of Revenue

P.O Box 740323

Atlanta, GA 30374-0323

What if I file or pay later than April 16, 2001?

You may be charged late filing and pay

ment penalties as well as interest.

-8-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12