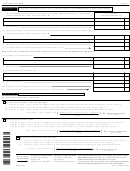

Form Nyc-115 - Unincorporated Business Tax Report Of Change In Taxable Income Made By Internal Revenue Service And/or New York State Department Of Taxation And Finance - 2002 Page 2

ADVERTISEMENT

Form NYC-115 - 2002

Page 2

SCHEDULE A

Explanation of Federal and/or New York State Adjustments

(if additional space is needed, attach schedule)

1. Items increasing profit (or loss) from business or profession (federal Schedule C) or partnership

COLUMN F

income (federal Form 1065) (see instructions)

Unincorporated Business Tax

2. Total increases

3. Items decreasing profit (or loss) from business or profession (federal Schedule C) or partnership

income (federal Form 1065) (see instructions)

4. Total decreases

5. Net (federal/New York State) adjustments (combine lines 2 and 4)

NEW YORK CITY CHANGES AFFECTING (Federal/New York State) ADJUSTMENTS LISTED ABOVE

6. Additions (see instructions)

7. Total additions

8. Subtractions (see instructions)

9. Total subtractions

10. Net New York City changes (combine lines 7 and 9)

11. Net reportable changes (transfer amount to page 1, column B, line 1)

Computation of Business Tax Credit - page 1, line 6, column C (check one)

SCHEDULE B

For years prior to 1987 see instructions

Business Tax Credit for 1987 through 1995

1. If the tax on page 1, line 5, Column C is $600 or less, your credit on line 6 is the entire amount of tax on page 1, line 5, column C

2. If the tax on page 1, line 5, Column C is $800 or over, no credit is allowed. Enter "0" on page 1, line 6, column C

3. If the tax on page 1, line 5, Column C is over $600 but less than $800, your credit is computed by the following formula:

) = ___________

tax on page 1, line 5, Column C X

$800 minus tax on page 1, line 5, Column C

(

(your credit)

$200

Business Tax Credit for 1996

1.

If the tax on page 1, line 5, Column C is $800 or less, your credit on line 6 is the entire amount of tax on page 1, line 5, Column C.

2.

If the tax on page 1, line 5, Column C is $1,000 or over, no credit is allowed. Enter “0” on page 1, line 6, Column C.

3.

If the tax on page 1, line 5, Column C is over $800 but less than $1,000, your credit is computed by the following formula:

) = ___________

tax on page 1, line 5, Column C X

$1,000 minus tax on page 1, line 5, Column C

(

(your credit)

$200

Business Tax Credit for 1997 and Later

1.

If the tax on page 1, line 5, Column C is $1,800 or less, your credit on line 6 is the entire amount of tax on page 1, line 5, Column C.

2.

If the tax on page 1, line 5, Column C is $3,200 or over, no credit is allowed. Enter “0” on page 1, line 6, Column C.

3.

If the tax on page 1, line 5, Column C is over $1,800 but less than $3,200, your credit is computed by the following formula:

) = ___________

tax on page 1, line 5, Column C X

$3,200 minus tax on page 1, line 5, Column C

(

(your credit)

$1,400

RETURNS WITH REMITTANCES

RETURNS CLAIMING REFUNDS

Attach copies of federal and/or New York State changes and explanation of items.

M A I L I N G

Make remittance payable to the order of NYC DEPARTMENT OF FINANCE

NYC DEPT. OF FINANCE

NYC DEPT. OF FINANCE

INSTRUCTIONS

Payment must be made in U.S. dollars, drawn on a U.S. bank.

PO BOX 5040

PO BOX 5050

To receive proper credit, you must enter your correct Employer Identification

KINGSTON, NY 12402-5040

KINGSTON, NY 12402-5050

Number and/or Social Security Number on your tax return and remittance.

60120291

NYC-115 - 2002 Rev. 12/02

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2