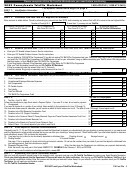

Fcc Form 499-A - Telecommunications Reporting Worksheet - 2003 Page 12

ADVERTISEMENT

Instructions to the Telecommunications Reporting Worksheet, Form 499-A

Note also that entities must file this Worksheet, and are subject to the universal service contribution requirement, if

they offer interstate telecommunications for a fee to the public even if only a narrow or limited class of users could

utilize the services. Included are entities that provide interstate telecommunications to entities other than themselves

for a fee on a private, contractual basis. In addition, owners of pay telephones, sometimes referred to as "pay

telephone aggregators," must file this Worksheet. Most telecommunications carriers must file this Worksheet even if

10

they qualify for the de minimis exemption under the Commission's rules for universal service.

The following three sections list types of (non-common carrier) telecommunications providers that are not required

to file FCC Form 499-A. Note that some carriers and telecommunications providers are required to file this

Worksheet, but may not be required to contribute to all support mechanisms. For example, some carriers may be

exempt from contributing to the universal service support mechanisms (e.g., because they are de minimis), but

nevertheless must file because they are required to contribute to TRS, NANPA, or LNPA.

1.

Universal service exe mption for de minimis telecommunications providers

Section 54.708 of the Commission’s rules states that telecommunications carriers and telecommunications providers

are not required to contribute to the universal service support mechanisms for a given year if their contribution for

11

that year is less than $10,000.

Thus, providers that offer telecommunications for a fee exclusively on a non-

common carrier basis need not file this Worksheet if their contribution to the universal service support mechanisms

would be de minimis under the universal service rules. Note: Entities that provide solely private line service may

nevertheless be considered common carriers if they offer their services directly to the public or to such classes of

users as to be effectively available directly to the public. In contrast, telecommunications carriers that meet the de

minimis standard must file this Worksheet (because they must contribute to other support and cost recovery

mechanisms), but need not contribute to the universal service mechanisms.

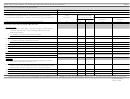

(See Figure 3 “Which

telecommunications providers must contribute for which purposes” at page 26, below.)

Non-telecommunications carriers should complete the table contained in Figure 1 to determine whether they meet

the de minimis standard.

To complete Figure 1, potential filers must first complete Block 4 of the

Telecommunications Reporting Worksheet and enter the amounts from Line 420(d) and 420(e) in Figure 1.

Telecommunications providers whose estimated contributions to universal service support mechanisms would be

less than $10,000 are considered de minimis for universal service contribution purposes and will not be required to

contribute directly to universal service support mechanisms. Use Figure 1 to calculate estimated universal service

contributions for the period January 2002 through December 2002.

Telecommunications providers that do not file this Worksheet because they are de minimis for purposes of universal

service contributions (and need not file for any other purpose) should retain Figure 1 and documentation of their

contribution base revenues for 3 calendar years after the date each Worksheet is due.

10

See 47 C.F.R. § 54.708.

11

Id.

Instructions -- Page 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34