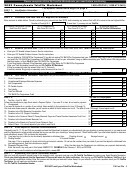

Fcc Form 499-A - Telecommunications Reporting Worksheet - 2003 Page 23

ADVERTISEMENT

Instructions to the Telecommunications Reporting Worksheet, Form 499-A

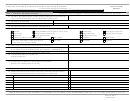

For the purposes of this Worksheet, “Revenues from services provided for resale by other contributors to federal

universal service support mechanisms” are revenues from services provided by underlying carriers to other entities

that currently are contributors to universal service support mechanisms and that are resold in the form of

telecommunications. Such revenues are referred to herein as "carrier's carrier revenues" or "revenues from

resellers." Revenues from all other sources consist primarily of revenues from services provided to end users,

referred to here as "end-user revenues." This latter category includes non-telecommunications revenues.

For the purpose of completing Block 3, a “reseller” is a telecommunications carrier or telecommunications provider

that: 1) incorporates purchased telecommunications services into its own telecommunications offerings; and 2) can

reasonably be expected to contribute to federal universal service support mechanisms based on revenues from such

offerings when provided to end users.

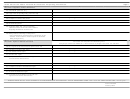

Each filer should have documented procedures to ensure that it reports as “revenues from resellers” only revenues

from entities that reasonably would be expected to contribute to support universal service. The procedures should

include, but not be limited to, maintaining the following information on resellers: Filer 499 ID; legal name; address;

name of a contact person; and phone number of the contact person. The filer should verify that each reseller will: 1)

resell the filer’s services in the form of telecommunications [and not as information services]; and 2) contribute

directly to the federal universal service support mechanisms. If the filer does not have independent reason to know

that the reseller satisfies these criteria, it should obtain a signed statement certifying that these criteria are met.

Current contributors to universal service are identified at

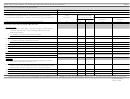

Note: For the purposes of filling out this Worksheet -- and for calculating contributions to the universal service

support mechanisms -- certain telecommunications carriers and other providers of telecommunications may be

exempt from contribution to the universal service support mechanisms.

These exempt entities, including

"international only" and "intrastate only" carriers and carriers that meet the de minimis universal service threshold,

should not be treated as resellers for the purpose of reporting revenues in Block 3. That is, filers that are underlying

carriers should report revenues derived from the provision of telecommunications to exempt carriers and providers

(including services provided to entities that are de minimis for universal service purposes) on lines (403-417) of

Block 4 of the Telecommunications Reporting Worksheet, as appropriate. Underlying carriers must contribute to the

universal service support mechanisms on the basis of such revenues. In Block 5, Line 511, however, filers may elect

to report the amounts of such revenues (i.e., those revenues from exempt entities that are reported as end-user

revenues) so that these revenues may be excluded for purposes of c alculating contributions to TRS, LNPA, and

NANPA.

2.

Column (a) - total revenues

The reporting entity must report gross revenues from all sources, including nonregulated and non-

telecommunications services on Lines (303) through (314) and Lines (403) through (418) and these must add to total

gross revenues as reported on Line (419). Gross revenues should include revenues derived from the activation and

provision of interstate, international, and intrastate telecommunications and non-telecommunications services. Gross

revenues consist of total revenues billed to customers during the filing period with no allowances for uncollectibles,

settlements, or out-of-period adjustments. Gross revenues should include collection overages and unclaimed refunds

for telecommunications services when not subject to escheats. Gross billed revenues may be distinct from booked

revenues. NECA pool companies should report the actual gross billed revenues (CABS Revenues) reported to the

NECA pool and not settlement revenues received from the pool.

Where two contributors have merged prior to the filing date, the successor company should report total revenues for

the reporting period for all predecessor operations. The two contributors, however, should continue to report

20

separately if each maintains separate corporate identities and continues to operate.

Where an entity obtains,

20

See also Section II-E, above.

Instructions -- Page 16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34