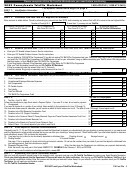

Fcc Form 499-A - Telecommunications Reporting Worksheet - 2003 Page 31

ADVERTISEMENT

Instructions to the Telecommunications Reporting Worksheet, Form 499-A

Line (604) -- Filers may use the box in Line (604) to request nondisclosure of the revenue information contained on

the Telecommunications Reporting Worksheet. By checking this box, the officer of the company signing the

Worksheet certifies that the information contained on the Worksheet is privileged or confidential commercial or

financial information and that disclosure of such information would likely cause substantial harm to the competitive

position of the company filing the Worksheet. This box may be checked in lieu of submitting a separate request for

25

confidentiality pursuant to section 0.459 of the Commission's rules.

All decisions regarding disclosure of

company-specific information will be made by the Commission. The Commission regularly makes publicly

available the names (and Block 1 and 2 -B contact information) of the entities that file the Telecommunications

Reporting Worksheet and information on which filers contribute to which funding mechanisms, including entities

that checked the boxes in Line (603).

Lines (605-608) -- An officer of the reporting entity must examine the data provided in the Telecommunications

Reporting Worksheet and certify that the information provided therein is accurate and complete. Officers of entities

making consolidated filings should refer to Section II-B, above and must certify that they comply with the conditions

listed in Section II-B. An officer is a person who occupies a position specified in the corporate by-laws (or

partnership agreement), and would typically be president, vice president for operations, vice president for finance,

comptroller, treasurer, or a comparable position. If the reporting entity is a sole proprietorship, the owner must sign

the certification. The signature on Line 605 must be in ink.

A person who willfully makes false statements on the Worksheet can be punished by fine or imprisonment under

26

title 18 of the United States Code.

Line (609) -- Indicate whether this filing is an original filing for the year, due on April 1, a registration filing for a

new service provider, a filing with revised registration information or a filing with revised revenue information. See

Sections II-C and II-E, above, for information on the obligation to file revisions.

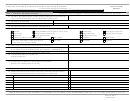

IV.

Calculation of Contributions

A.

Contribution Requirements

Most filers must contribute to the universal service, TRS, NANPA, and LNPA funding mechanisms. This section

provides a short summary to assist carriers and service providers in determining whether they must contribute to one

or more of the mechanisms. Filers should consult the Commission's rules and orders to determine whether they

must contribute to one or more of the mechanisms.

Federal universal service support mechanisms. Entities that provide interstate telecommunications to the public

for a fee must contribute to the universal service support mechanisms. See 47 C.F.R. § 54.706.

Telecommunications Relay Services. Every common carrier providing interstate telecommunications services

shall contribute to the TRS Fund. See 47 C.F.R. § 64.604.

North American Numbering Plan Administration. All telecommunications carriers in the United States shall

contribute to meet the costs of establishing numbering administration. See 47 C.F.R. § 52.17.

25

47 C.F.R. § 0.459. See also Examination of Current Policy Concerning the Treatment of Confidential Information

Submitted to the Commission, GC Docket No. 96-55, Report and Order, 13 FCC Rcd 24816 (1998) (listing the

showings required in a request that information be withheld and stating that the Commission may defer action on such

requests until a formal request for public inspection has b een made).

26

See 18 U.S.C. § 1001.

Instructions -- Page 24

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34