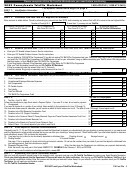

Fcc Form 499-A - Telecommunications Reporting Worksheet - 2003 Page 28

ADVERTISEMENT

Instructions to the Telecommunications Reporting Worksheet, Form 499-A

Line (412) -- International calls that traverse the United States but both originate and terminate in foreign points are

excluded from the universal service contribution base regardless of whether the service is provided to resellers or to

end users. These revenues should be segregated from other toll revenues by showing them on Line (412).

Telecommunications providers should not report international settlement revenues from traditional settlement

transiting traffic on the Worksheet.

Line (310) and Line (413) -- Operator and toll calls with alternative billing arrangements should include all calling

card or credit card calls, person-to-person calls, and calls with alternative billing arrangements such as third-number

billing, collect calls, and country-direct type calls that either originate or terminate in a U.S. point. These lines

should include all charges from toll or long distance directory assistance. Lines (310) and (413) should include

revenues from all calls placed from all coin and coinless, public and semi-public, accommodation and prison

telephones, except that calls that are paid for via prepaid calling cards should be included on line (411) and calls paid

for by coins deposited in the phone should be included on line (407).

Line (311) and Line (414) -- Ordinary long distance and other switched toll services should include amounts from

account 5100 -- long distance message revenues-- except for amounts reported on Lines (310), (407), (411), (412) or

(413). Line (311) and Line (414) should include ordinary message telephone service (MTS), WATS, toll-free, 900,

"WATS-like," and similar switched services. This category includes most toll calls placed for a fee and should

include flat monthly charges billed to customers, such as account maintenance charges, PICC pass-through charges,

package plans giving fixed amounts of toll minutes, and monthly minimums.

Line (312) and Line (415) -- Long distance private line service should include revenues from dedicated circuits,

private switching arrangements, and/or predefined transmission paths, extending beyond the basic service area. Line

(312) and Line (415) should include frame relay and similar services where the customer is provided a dedicated

amount of capacity between points in different basic service areas. This category should include revenues from the

resale of special access services if they are included as part of a toll private line service.

Line (313) and Line (416) -- Satellite services should contain revenues from providing space segment service and

earth station link-up capacity used for providing telecommunications or telecommunications services via satellite.

Revenues derived from the lease of bare transponder capacity should not be included on lines (313) and (416).

Line (314) and Line (417) -- All other long distance services should include all other revenues from providing long

distance communications services. Line (314) and Line (417) should include toll teleconferencing. Line (314) and

Line (417) should include switched data, frame relay and similar services where the customer is provided a toll

network service rather than dedicated capacity between two points.

Other revenue categories

Line (403) -- Itemized charges levied by the reporting entity in order to recover contributions to state and federal

universal service support mechanisms should be classified as end-user billed revenues and should be reported on

Line (403). Any charge that is identified on a bill as recovering contributions to the universal service support

mechanisms must be shown on Line (403) and should be identified as either interstate or international revenues, as

appropriate.

Line (418) -- Other revenues that should not be reported in the contribution bases. Line (418) should include all

non-telecommunications service revenues on the reporting entity's books as well as some revenues that are derived

from telecommunications-related functions but that should not be included in the universal service or other fund

contribution bases. For example, information services offering a capability for generating, acquiring, storing,

transforming, processing, retrieving, utilizing, or making available information via telecommunications are not

included in the universal service or other fund contribution bases. Information services do not include any use of

any such capability for the management, control, or operation of a telecommunications system or the management of

Instructions -- Page 21

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34