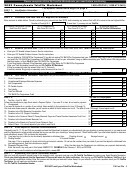

Fcc Form 499-A - Telecommunications Reporting Worksheet - 2003 Page 33

ADVERTISEMENT

Instructions to the Telecommunications Reporting Worksheet, Form 499-A

B.

Contribution Bases

Filers do not calculate, in this Worksheet, the amounts that they must contribute. The administrators will use the

revenue information on the Worksheet to calculate a funding base and individual contributions for each support

mechanism. Individual contributions are determined by the use of "factors" -- factors reflect the total funding

requirement of a particular mechanism divided by the total contribution base for that mechanism. Information on

the contribution bases and individual filer contributions are shown in Figure 4.

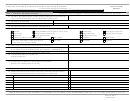

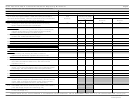

Figure 4: Contribution bases

Support Mechanism

Funding Basis

Line (420)(d) + Line 420(e) *

Universal service low income and high cost;

Universal service schools and libraries and rural

less

revenues corresponding to actual

health care

contributions**

TRS

(Filers with end-user revenues must pay a

Line (420)(d) + Line 420(e)

minimum of $25)

plus

Line (412)(e)

less

Line (511)(b)

NANPA (Filers with end-user revenues must

Line (420)(a)

pay a minimum of $25. Filers with no

plus

Line (412)(a)

end-user revenues must pay $25.)

less

Line (511)(a)

LNPA - by region

Line (420)(a)

(Filers with no end-user revenues must pay

plus

Line (412)(a)

$100)

less

Line (511)(a)

times

percentage of end-user revenues shown on

lines (503) through (509)

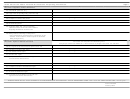

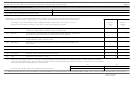

* Starting in April 2003 actual monthly billings for universal service are based on projected collected

revenue information filed on the quarterly FCC Form 499-Q. Historic al amounts reported on Line

(116)(b) and (c) on the Form 499-Q correspond to Line (420)(d) and (e), respectively. The Form 499

Q provides instructions for projecting revenues, and for removing uncollectible amounts from gross

billed revenue projections. The amounts filed on the Form 499-A are used to review and true-up Form

499-Q filings and associated contributions.

Line 420(e) is excluded if the total of amounts on Line 420(d) for the filing entity consolidated

**

with all affiliates is less than 12% of the total of Line 420(d) + Line 420(e) for the filing entity

consolidated with all affiliates. See 47 C.F.R. §54.706(c). For the second quarter of 2002 through the

first quarter of 2003, the contribution b ase for an individual filer will be the subject interstate and

international revenues from two quarters prior, less the universal service contributions actually made in

28

that prior quarter.

Starting in the second quarter April 2003, the contribution base for an individual

filer will be the projected collected interstate and international revenues for the quarter, reduced by an

imputed amount of universal service support pass-through charges, based on the actual factor for the

29

quarter.

28

See First Further Notice, 17 FCC Rcd 3752 (2002).

29

See Contribution Methodology Order, FCC 02-329 (rel. Dec. 13, 2002).

Instructions -- Page 26

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34