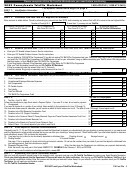

Fcc Form 499-A - Telecommunications Reporting Worksheet - 2003 Page 29

ADVERTISEMENT

Instructions to the Telecommunications Reporting Worksheet, Form 499-A

a telecommunications service. Information services also are called enhanced services because they are offered over

common carrier transmission facilities used in interstate communications and employ computer processing

applications that act on the format, content, code, protocol, or similar aspects of the subscriber's transmitted

information; provide the subscriber additional, different, or restructured information; or involve subscriber

interaction with stored information. For example, call moderation and call transcription services are information

services. These services are exempt from contribution requirements and should be reported on line (418). Line

(418) should include revenues from published directory and carrier billing and collection services. Line (418)

should include revenues from the sale, lease, installation, maintenance, or insurance of customer premises equipment

(CPE), inside wiring charges, inside wiring maintenance insurance. Line (418) should include the sale or lease of

transmission equipment, such as dark fiber, that is not provided as part of a telecommunications service. Line (418)

should include revenues from providing open video systems (OVS), cable leased access, and direct broadcast

satellite (DBS) services. Line (418) should include late payment charges and charges (penalties) imposed by the

company for customer checks returned for non-payment.

Line (418) should include revenues from

telecommunications services provided in a foreign country where the traffic does not transit the United States or

where the carrier is providing service as a foreign carrier, i.e. a carrier licensed in that country.

Line (419) -- Gross billed revenues from all sources should equal the sum of revenues by type of servic e reported on

Lines (303) through (314) and Lines (403) through (418).

Line (420) -- Universal service contribution base. Enter the subtotal of Lines (403) through (411) and Lines (413)

through (417). The totals on this line represent end-user revenues for the purpose of determining contributions to

universal service support mechanisms.

Note that these lines contain end-user revenues from carriers and

telecommunications service providers that are exempt (e.g., carriers that meet the universal service de minimis

exception, or that provide "international only" service) from contributing to universal service support mechanisms.

Since these universal service exempt entities generally do contribute directly to the TRS, local number portability,

and NANPA mechanisms, revenues from these entities need not be included in contribution bases for those

mechanisms. Thus, underlying carriers may, if they elect to, identify these amounts on Line (511).

Notes for carriers that use the USOA

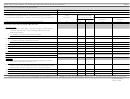

The revenue accounts in the current USOA generally correspond to revenue lines in Block 3 and Block 4. For

example, revenue amounts recorded in accounts 5001, 5002, 5050, 5060 and 5069 should be reported on Line 303

or Line 404, as appropriate. Similarly, revenues recorded in account 5280 should be reported on Line 407. There

are some exceptions. For example, monthly and connection revenues from mobile services provided to end users

in account 5004 should be reported on Line 409. Per-minute revenues from end users in account 5004 should be

reported on Line 410. However, revenues in account 5004 from exchanging traffic with mobile service carriers

should be reported on Line 304. Similarly, state per-minute access revenues recorded in account 5084 should be

reported on Line 304; state special access revenues recorded in account 5084 should be reported on Line 305 and

Line 406, as appropriate; and, state subscriber line charge revenues recorded in account 5084 should be reported

on Line 405.

24

The Commission recently adopted changes to the USOA.

The change in account structure will not change which

revenues should be reported on which Form 499 lines. Once carriers implement the new account structure, most

revenues classified in account 5001 -- basic area revenues, will continue to be reported on Line (303) or Line

(404). However, local exchange carrier revenues from mobile carriers for calls between wireless and wireline

customers will continue to be reported on Line (304) and revenues from mobile services will continue to be

reported on Line (309), Line (409) or Line (410), as appropriate. Revenues classified in account 5200,

24

See 2000 Biennial Regulatory Review – Comprehensive Review of the Accounting Requirements and ARMIS

Reporting Requirements for Incumbent Local Exchange Carriers: Phase 2, CC Docket No. 00-199, Report and

Order in CC Docket Nos. 00-199, 97-212, and 80-286 and Further Notice of Proposed Rulemaking in CC Docket

Nos. 00-199, 99-301, and 80-286, 16 FCC Rcd 19911 (2001).

Instructions -- Page 22

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34