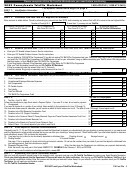

Fcc Form 499-A - Telecommunications Reporting Worksheet - 2003 Page 17

ADVERTISEMENT

Instructions to the Telecommunications Reporting Worksheet, Form 499-A

If you have questions regarding contribution amounts, billing procedures or the support and cost recovery

mechanisms, you may contact:

Universal Service Administration

(202) 776-0200

TRS Administration

(973) 884-8173

NANPA Billing and Collection Agent

(973) 884-8173

Local Number Portability Administrators

(877) 245-5277

D.

Rounding of Numbers and Negative Numbers

All information provided in the Worksheet should be neatly printed in ink or typed. Please provide an original

officer signature in ink on Line 605.

Dollar Amounts. Reported revenues in Blocks 3, 4 and 5 that are greater than a thousand dollars may be rounded to

the nearest thousand dollars. Regardless of rounding, all dollar amounts must be reported in whole dollars . For

example, $2,271,881.93 could be reported as $2,271,882 or as $2,272,000, but could not be reported as $2272

thousand, $2,270,000.00, $2,271,881.93, or $2.272 million. Please enter $0 in any line for which the filer had no

revenues for the year.

Percentages. Percentages reported in Block 3 and Block 4, columns (b) and (c), should be rounded to the nearest

whole percent. For example, if the exact amount of interstate revenues for a line is not known, but the filer estimates

that the ratio of interstate to total revenues was .425, then the figure 43% should be reported and used for calculating

the amount reported in column (b).

Negative Numbers. Carriers are directed to provide billed revenues without subtracting any expenses, allowances for

uncollectibles or settlement payments and without making out-of-period adjustments. Therefore, do not enter

negative numbers on the Worksheet.

E.

Obligation to File Revisions

Line (609) provides check boxes to show whether the Worksheet is the original April 1 filing for the year, a

registration form for a new filer, a revised filing with updated registration information, or a revised filing with

updated revenue data for the year. Filers must submit a revised Form 499-A if there is a change in any of the

following types of information: Contributor identification contained in Block 1; regulatory contact information

contained in Block 2-A; agent for service of process in Block 2-B; or FCC registration information in Block 2-C.

A filer must submit a revised Worksheet if it discovers an error in the revenue data that it reports. Companies

generally close their books for financial purposes by the end of March. Accordingly, for such telecommunications

providers, the April 1 filing should be based on closed books. Filers should not include (carry back or bring

forward) routine out-of-period adjustments to revenue data unless such adjustments would affect a reported amount

by more than ten percent. To file revised revenue data, filers must complete Block 3, Block 4, Block 5, and Block 6.

Filers should not file revised revenue information to reflect mergers, acquisitions, or sales of operating units. In the

event that a filer that submitted a Form 499-A no longer exists, the successor company to the contributor's assets or

operations is responsible for continuing to make payments, if any, for the funding period and must notify the Form

499 Data Collection Agent.

Filers should submit revised Form 499-A revenue data by December 1 of the same filing year. Revisions filed after

that must be accompanied by an explanation of the cause for the change along with complete documentation

showing how the revised figures derive from corporate financial records.

Instructions -- Page 10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34