Instructions For Form Cr-A - Commercial Rent Tax Annual Return Page 2

ADVERTISEMENT

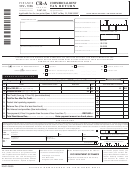

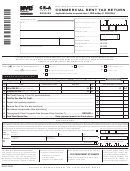

Instructions for Form CR-A for the Period of June 1, 2009 to May 31, 2010 ONLY

Page 2

quently receives a refund or credit from

occurs within five days of the postmark date.

IMPORTANT INFORMATION

the landlord. Notwithstanding the pro-

If the five-day limit is exceeded, the tax-

tective refund claim, no refund of Com-

payer must establish: a) the item was actu-

G

Taxpayers whose annualized base rent

mercial Rent Tax will be paid unless

ally deposited in the mail by the due date; b)

before the 35% rent reduction and the

and until the property tax refund or

the delay in receipt was due to a delay in the

NYC Commercial Revitalization Pro-

credit is received from the landlord and

transmission of the mail; and c) the cause of

gram special reduction is less than

the tenant submits, with a copy of this

the delay.

$250,000 are no longer subject to the

return, sufficient information to estab-

Commercial Rent Tax. However, a tax

lish the amount of any such overpay-

If the due date falls on a Saturday, Sunday

return may be required to be filed.

ment.

or legal holiday, the due date is extended to

the next succeeding business day.

G

A tax credit is allowed for taxpayers

GENERAL INFORMATION

whose annualized base rent before the

For late filings of quarterly returns, interest

35% rent reduction and the NYC Com-

must be paid on the amount of the under-

mercial Revitalization Program special

FORMS TO BE USED AND

payment from the due date until the earlier

reduction is at least $250,000, but is less

PERIODS COVERED

of (1) 20 days after the end of the tax year, or

than $300,000. The tax credit is calcu-

An annual return (CR-A) is required to be

(2) the date as of which the tax paid for the

lated on page 2, line 16.

filed by every tenant, on or before June 20,

tax year equals 75% of the full tax required

covering the preceding year from June 1 to

to be paid for the tax year. The interest

G

A tax return is no longer required to be

May 31. Every tenant subject to tax for a pe-

must be paid with the annual return. For

filed with respect to any premises if

riod must file a quarterly return (Form CR-

calculation of interest information, call 311.

your annualized gross rent paid is

Q).

Quarterly returns are due for the

Interest amounting to less than $1 need not

$200,000 or less and you do not receive

three-month periods ending on the last days

be paid.

over $200,000 in rent from any sub-

of August, November and February of each

tax year and must be filed within 20 days

tenant.

WHO IS A TENANT

after the end of the period they cover.

A tenant is a person who pays or is required

G

A 35% rent reduction is allowed in com-

to pay rent for premises as a lessee, subles-

Every tenant subject to tax must file an an-

puting base rent subject to Commercial

see, licensee or concessionaire. No tax re-

Rent Tax.

nual return on Form CR-A. In addition,

turn need be filed if the individual or the

every tenant not subject to tax for periods

business entity is the same individual or en-

beginning on or after June 1, 2001 because

G

The applicable tax rate for each taxable

tity owning the premises. The tax form

premises is based on the Base Rent Be-

its annualized base rent before the 35% rent

should be returned to the Department of Fi-

fore Rent Reduction and the NYC Com-

reduction and the NYC Commercial Revi-

nance stating the owner’s name and address,

mercial Revitalization Program special

talization Program special reduction is less

Employer Identification Number or Social

reduction (lines 7 and 5b, or line 12, if

than $250,000 (refer to Exemptions, below),

Security Number, the address of the property

applicable). However, that tax rate is

will not be required to file an annual return

and the block and lot number as shown on

applied to the Base Rent Subject to Tax

(CR–A) if, with respect to any premises,

the real estate tax bill. Shareholders in co-

(line 9) in determining your tax for each

its annualized gross rent is $200,000 or

operative corporations are not considered

taxable premises. If that amount is less

less, and it does not receive over $200,000

“owners of record.”

than $250,000, no tax is due. If that

in rent from any subtenant.

amount is at least $250,000 but less than

The following situations do not exempt the

If a tenant ceases to do business, the tax is

$300,000, a tax credit is allowed.

tenant from tax:

due immediately, and the tenant must file a

G

In computing base rent, rent received

final return for the entire year (Form CR-A)

a) where a building is owned, not by a ten-

within 20 days from the date the tenant

from subtenants may be deducted by a

ant but by a spouse or parent of the ten-

prime tenant, regardless of the amount.

ceases to do business. If the tenant never-

ant;

theless continues to pay rent for the taxable

premises, in which case the tenant must con-

G

The Commercial Rent Tax has been re-

b) where a building is owned by the tenant

pealed with respect to rent paid for all

tinue to file returns and pay the tax.

jointly or in common with another per-

premises located north of the center line

son, other than a spouse;

of 96th Street in Manhattan and the

If a tax return or payment is delivered to the

boroughs of the Bronx, Brooklyn,

Department of Finance by U.S. mail after the

c) where a building is owned by a corpora-

Queens and Staten Island.

due date, the date of the U.S. Postal Service

tion of which the tenant is an officer or

postmark stamped on the envelope will be

holder of all or part of the corporate

G

The submission of this return repre-

considered the date of delivery, provided the

stock;

sents an automatic protective refund

postmark date falls on or before the due date

claim for any overpayment of the tax

including any extension and the return was

d) where the tenant is a corporation and the

reported on this return that results

deposited in the mail, postage prepaid and

building is owned by a subsidiary corpo-

properly addressed. Non-U.S. Postal Serv-

from the inclusion in base rent of NYC

ration or by a parent corporation;

Real Property Tax escalation payments

ice postmarks will also be recognized, pro-

for which the tenant/taxpayer subse-

vided delivery to the Department of Finance

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6