Instructions For Form Cr-A - Commercial Rent Tax Annual Return Page 6

ADVERTISEMENT

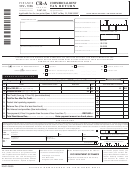

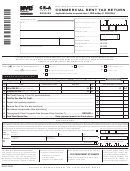

Instructions for Form CR-A for the Period of June 1, 2009 to May 31, 2010 ONLY

Page 6

LINES 1 AND 2 -

of interest, call the Customer Assistance

Enter the amount of payment remitted with

COMPUTATION OF TAX DUE

number given under that heading. Interest

this return on line A in the space provided.

Enter the number of taxable premises you

amounting to less than $1 need not be paid.

have occupied or used during the tax period

G

Be sure that your name, EIN or SSN, and

in the appropriate columns on lines 1 and 2.

Additional Charges

Account ID Number appear on the face

a)

A late filing penalty is assessed if you

of the check.

Enter on lines 1 and 2, whichever applies,

fail to file an annual return when due,

G

Don’t forget to sign your return.

your base rent totals for all premises in each

unless the failure is due to reasonable

class calculated on lines 13 and 14 from

cause. For every month or partial month

page 2. Multiply “total base rent” on line

that this form is late, add to the tax (less

CUSTOMER SERVICE FOR

2 by the tax rate of 6% and enter the result

any payments made on or before the due

COMMERCIAL RENT TAX ONLY

in the column under “tax due.”

This

date) 5%, up to a total of 25%.

If you have a Commercial Rent Tax-related

amount should equal the total tax due be-

question or concern, please call (212) 232-

fore credit of all the premises of line 15

b)

If the annual return is filed more than

1265/1267 Monday through Friday, between

from page 2.

60 days late, the penalty imposed

the hours of 9:00 a.m. and 5:00 p.m. Hear-

under a will not be less than the lesser

ing and speech impaired customers can call

LINE 3 - TAX CREDIT

of (1) $100 or (2) 100% of the amount

our TTY number at (212) 504-4115.

Enter the total amount of tax credit of all

required to be shown on the form (less

the premises from line 16, page 2.

any payments made by the due date or

You can receive information or contact us by

credits claimed on the return).

visiting the Department of Finance’s Inter-

LINE 4 - TOTAL TAX DUE AFTER

net web site at nyc.gov/finance.

TAX CREDIT

c)

A late payment penalty is assessed if

Deduct line 3 from line 2 and enter the re-

you fail to pay the tax shown on this

DID YOUR MAILING

sult on line 4.

form by the prescribed filing date, un-

ADDRESS CHANGE?

less the failure is due to reasonable

If so, please visit us at nyc.gov/finance and

LINE 5 - PAYMENTS

cause.

For every month or partial

click “Update/Change Business Name or

Enter on line 5 the payments you have pre-

month that your payment is late, add to

Address” in the blue “BUSINESS IN-

viously made with your quarterly returns

the tax (less any payments made) 1/2%,

COME & EXCISE TAXES” box. This

(Forms CR-Q).

up to a total of 25%.

will bring you to the “Business Name / Ad-

dress Update” page.

LINE 6 - BALANCE DUE

d)

The total of the additional charges in a

Deduct line 5 from line 4. The result will

and c may not exceed 5% for any one

PRIVACY ACT NOTIFICATION

be:

month except as provided for in b.

The Federal Privacy Act of 1974, as

amended, requires agencies requesting So-

a) your balance of tax due for the tax year,

e) If a tenant, exempt from tax because

cial Security Numbers to inform individuals

which you will enter on line 6; or

the rent for the entire year is less than

from whom they seek this information as to

the applicable threshold amounts, fails

whether compliance with the request is vol-

b) your overpayment, if line 5 is greater

to file an annual return if required, a

untary or mandatory, why the request is

than the sum of line 4 and line 7 which

penalty of $100 may be imposed.

being made and how the information will be

you will enter on line 8.

used. The disclosure of Social Security

LINE 8 - OVERPAYMENT/REFUND

Numbers by taxpayers is mandatory and is

LINE 7 - INTEREST/ADDITIONAL

Complete this line if line 5 is greater than

required by section 11-102.1 of the Admin-

CHARGES

the sum of line 4 and line 7.

istrative Code of the City of New York. Dis-

Enter any interest and/or penalty on line 7.

closure by subtenants is voluntary. Such

NOTE: If you wish to claim a refund for a

numbers disclosed on any report or return

Interest

prior tax period, file an amended return

are requested for tax administration pur-

If the tax due with a quarterly return is not

using the appropriate form for that period

poses and will be used to facilitate the pro-

filed with the Department of Finance on or

showing the adjusted information. Mail the

cessing of tax returns and to establish and

before the due date of the quarterly return, in-

amended return to the address indicated in

maintain a uniform system for identifying

terest must be paid on the amount of the un-

“When and Where to File” on page 2.

taxpayers who are or may be subject to taxes

derpayment from the due date until the earlier

administered and collected by the Depart-

of (1) 20 days after the end of the tax year, or

LINE 9 - TOTAL REMITTANCE DUE

ment of Finance. Such numbers may also be

(2) the date as of which the tax paid for the

1. To obtain the total amount due (line 9),

disclosed as part of information contained in

year equals 75% of the full tax required to be

add line 6 and line 7. However, if line 5

the taxpayer’s return to another department,

paid for the tax year. The interest must be

does not exceed the sum of lines 4 and 7,

person, agency or entity as may be required

paid with the annual return. If the tax payable

to obtain the total amount due, add lines

by law, or if the taxpayer gives written au-

with the annual return is not paid by the due

4 and 7 and subtract line 5.

thorization to the Department of Finance.

date, interest on the amount of the underpay-

ment must be paid from the due date of the

2. Make your check payable to the order of:

annual return to the date paid. For calculation

NYC Department of Finance

CR-A Instructions 2009/2010

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6