Instructions For Form Cr-A - Commercial Rent Tax Annual Return Page 5

ADVERTISEMENT

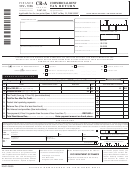

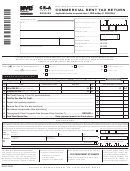

Instructions for Form CR-A for the Period of June 1, 2009 to May 31, 2010 ONLY

Page 5

b)

the vehicle is used for commercial pur-

of the base rent for such twelve-month pe-

pancy or use of such premises began and

poses by the tenant; and

riod or the base rent for the base year. see

ended. Compute the number of months oc-

Administrative Code §11-704.i.2.(b-2).

cupied or used to the nearest full month and

c)

a completed Certificate of Assigned Space

For more information concerning eligibility

enter.

Use has been taken from the tenant.

requirements under the NYC Commercial

Revitalization Program, please e-mail:

LINE 11 - MONTHLY BASE RENT

LINE 5a - OTHER DEDUCTIONS

BEFORE RENT REDUCTION

nyc.gov/contactfinance

Enter here any amounts included in gross

Divide the sum of lines 7 and 5b by line 10

rent allowable as deductions for eligible tax-

to arrive at the average monthly base rent

payers and detail such deductions on an at-

before rent reduction.

SPECIAL NOTE FOR

tached schedule.

ELIGIBLE TAXPAYERS

LINE 12 - ANNUALIZED BASE RENT

The amount of the special reduction available

LINE 5b - COMMERCIAL REVITAL-

BEFORE RENT REDUCTION

to eligible taxpayers under the NYC Com-

IZATION PROGRAM SPECIAL RE-

Multiply line 11 by 12 (months). This is

mercial Revitalization Program (line 5b) IS

DUCTION. (SEE HIGHLIGHTS OF

your annualized base rent before rent reduc-

NOT taken into account and must be added to

NEW LEGISLATION)

tion.

the line 7 amount for the following purposes:

The NYC Commercial Revitalization Pro-

gram provides both Real Estate Tax and

LINES 13 AND 14 - RATE CLASS

G

annualizing the base rent (lines 10a-12),

Commercial Rent Tax benefits with respect

G

If lines 10a through 12 are not applicable,

to qualifying leases of premises in the Title

and if the sum of lines 7 and 5b is $249,999

G

determining whether the taxpayer is ex-

4 abatement zone, defined generally as the

or less, transfer the amount on line 9 (not

empt because its base rent is below

area in Manhattan bounded by Murray Street

the amount on line 7) to line 13. If the

$250,000 for periods beginning on or

and Frankfort Street on the north, and South

sum of lines 7 and 5b is $250,000 or more,

after June 1, 2001 (see "EXEMPTIONS"

Street, Battery Place and West Street on the

transfer the amount on line 9 (not the

on page 2 of these instructions),

east, south and west, respectively. Effective

amount on line 7) to line 14.

G

for qualifying leases signed between July 1,

determining the amount of credit avail-

2005 and June 30, 2013, the premises can be

G

If lines 10a through 12 are applicable, and

able (line 16), and

in eligible buildings located south of Canal

if the line 12 amount is $249,999 or less,

G

determining the applicable tax rate.

Street. Leases must be new, renewal or ex-

transfer the amount on line 9 (not the

However, once the applicable rate is de-

pansion leases with lease commencement

amount on line 12) to line 13. If the line

termined, enter the amount on line 9

dates beginning on or after April 1, 1997 and

12 amount is $250,000 or more, transfer

(after the special reduction) on line 13 or

must meet minimum lease term and expen-

the amount on line 9 (not the amount on

14, whichever is applicable.

diture requirements. Expanded benefits are

line 12) to line 14.

available for qualifying leases signed be-

tween July 1, 2005 and June 30, 2013.

G

Transfer the totals of lines 13 and 14 to

lines 1 and 2 respectively, page 1 of the

LINE 6 - TOTAL DEDUCTIONS

Under the original program, for leases with

form.

Add lines 3 through 5b and enter the total

an initial lease term of at least three years

deductions in line 6.

but less than five years, the special reduction

LINE 15 - TAX DUE BEFORE CREDIT

is available for up to 36 months. The reduc-

Multiply line 14 amounts by 6% and enter

LINE 7 - BASE RENT BEFORE

tion for the base year, i.e., the twelve month

the result on line 15. This is your tax due

THE 35% RENT REDUCTION

period commencing on the rent commence-

before the tax credit. The total of line 15

Subtract line 6 from line 2 to obtain the

ment date, is equal to the base rent. The spe-

should equal the amount calculated as tax

amount of your base rent before the 35%

cial reduction for the two twelve month

due on line 2, page 1 of the form.

rent reduction.

periods following the base year is equal to

2/3 and 1/3, respectively, of the lesser of the

LINE 16 - TAX CREDIT

LINE 8 - 35% RENT REDUCTION

base rent for that 12 month period or the

Compute your tax credit using the Tax

Multiply line 7 by 35% and enter here.

base rent for the base year. Where the lease

Credit Computation Worksheet provided at

is at least five years long, the special reduc-

the bottom of page 2 of the form and enter

LINE 9 - BASE RENT SUBJECT

tion is available for up to sixty months with

the result on line 16. Transfer the total of line

TO TAX

a similar decrease for the last two twelve

16 to line 3, page 1 of the form.

Subtract line 8 from line 7 to obtain the

month periods of that period. See Adminis-

amount of your base rent subject to tax.

trative Code §11-704.i.2.(b) and (b-1). Ef-

PAGE 1

fective August 30, 2005, for qualifying

Computation of Tax

ANNUALIZATION OF BASE RENT

leases (which do not include subleases) with

Complete lines 10a through 12 only if the

LINE A - PAYMENT

an initial or renewal lease term of at least

amount shown on line 7 does not represent

Enter the amount of payment remitted with

five years, signed between July 1, 2005 and

rent paid for a full twelve-month period.

June 30, 2013, the special reduction for the

this return in the space provided.

base year is equal to the base rent and for all

LINE 10a - MONTHS AT PREMISES

other 12 month periods is equal to the lesser

Enter the dates (month and year) that occu-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6