Instructions For Form Cr-A - Commercial Rent Tax Annual Return Page 4

ADVERTISEMENT

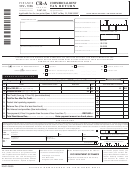

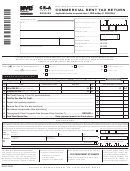

Instructions for Form CR-A for the Period of June 1, 2009 to May 31, 2010 ONLY

Page 4

profit organizations may be exempt from

G

Give the Department any information

hotel suite, or other accommodation that you

the tax. For more information, see Sec-

missing from your return,

use or occupy for commercial activities and

tions 7-04 through 7-06 of the Commer-

claim as a business deduction, the full

cial Rent Tax Rules. (Title 19, Rules of

amount of the rent must be entered. If you

G

Call the Department for information about

the City of New York, Chapter 7)

the processing of your return or the status

pay a single rent to one lessor for two or

of your refund or payment(s), and

more taxable premises, see section 7-01 “Al-

COMBINED BUSINESS/

location of single rent for two or more tax-

RESIDENTIAL USE

G

Respond to certain notices that you have

able premises” of the Commercial Rent Tax

Where a tenant pays an undivided rent for a

shared with the preparer about math er-

Rules (Title 19, Rules of the City of New

premises used both for residential and busi-

York, Chapter 7) for the method to be used

rors, offsets, and return preparation. The

ness purposes, the tax applies to that part of

notices will not be sent to the preparer.

to allocate rent among the taxable premises.

the rent that is attributable to the part of the

premises used for business purposes. In such

LINE 3 - RESIDENTIAL RENT

You are not authorizing the preparer to re-

a case, the rent attributable to business use

ceive any refund check, bind you to anything

If you use your home for business and resi-

is the amount which the tenant deducts as

(including any additional tax liability), or

dential purposes, enter here the amount of

rent for the premises for federal income tax

otherwise represent you before the Depart-

the rent attributable to residential use only.

purposes.

ment. The authorization cannot be revoked,

It is presumed that the amount you claimed

as a business deduction for rent on your fed-

however, the authorization will automati-

WHEN AND WHERE TO FILE

cally expire no later than the due date (with-

eral income tax return is the amount of rent

File your return within 20 days after the end

out regard to any extensions) for filing next

attributable to business use of the premises.

of the period covered by this return. Penalty

year's return. Failure to check the box will

and interest will be assessed for returns filed

be deemed a denial of authority.

LINE 4 - RENT FROM SUBTENANT(S)

late. The return should be mailed to:

Enter here amounts paid or due to you as

rent from any subtenant. In computing base

NYC Department of Finance

rent, rent received from a subtenant subject

SPECIFIC INSTRUCTIONS

P.O. Box 5150

to the tax or not subject to tax for the tax

Kingston, NY 12402-5150

year because its annualized base rent is less

PAGE 2 - Computation of Base Rent

than $250,000 for period beginning on or

HOW TO COMPLETE ANNUAL

after June 1, 2001, and rent received from a

For purposes of completing this form

TAX FORM CR-A

subtenant that is a governmental entity, the

round off cents to the nearest whole dollar.

G

Complete this return by beginning on

UN, or a nonprofit religious, charitable or

educational entity exempt from the tax, may

page 2.

LINE 1 - TAXABLE PREMISES

be deducted by a prime tenant.

Enter address, zip code and block and lot

G

Complete the entire schedule for each

number of each taxable premises where the

Also enter the subtenant’s name, Employer

premises.

annualized gross rent exceeds $200,000. To

Identification Number (for corporations or

find the block and lot number corresponding

USE THIS PAGE IF YOU HAVE THREE

partnerships) or Social Security Number (if

to the taxable premises, log on to the Depart-

OR LESS PREMISES / SUBTENANTS

a sole proprietorship). Note that such rents

OR, MAKE COPIES OF THIS PAGE TO

ment of Finance website at nyc.gov/finance

REPORT ADDITIONAL PREMISES/SUB-

may be deducted only from the gross rent of

and mouse over the Real Estate Tax (blue bar)

TENANTS. IF YOU WISH TO REPORT

the premises which the subtenant occupies

drop down menu, click on “Assessment Roll”

MO RE

TH AN

TH REE

PR EMISES /

and may not be applied against any other

SUB TENAN TS,

AN D

C HOOSE

TO

and click on “Search by Address”. Alterna-

premises rented by the taxpayer.

U U S S E E A A S S P P R R E E A A D D S S H H E E E E T T , , Y Y O O U U M M U U S S T T

tively, the block and lot number can be ob-

U U S S E E T T H H E E F F I I N N A A N N C C E E S S U U P P P P L L E E M M E E N N T T A A L L

tained from your landlord or managing agent.

S S P P R R E E A A D D S S H H E E E E T T , ,

W W H H I I C C H H

Y Y O O U U

C C A A N N

If you have more than one subtenant, make

If you have more than three such premises,

D D O O W W N N L L O O A A D D F F R R O O M M O O U U R R W W E E B B S S I I T T E E A A T T

copies of page 2 or attach a schedule giving

make copies of page 2 or attach a schedule

the same details as required on page 2.

giving the same information required by the

Preparer Authorization: If you want to

form showing figures and computations

In entering amounts paid by subtenants

allow the Department of Finance to discuss

clearly. Make sure the copies or the schedule

whose rent is based on a percentage of sales

your return with the paid preparer who signed

bear the taxpayer’s name, address, period

receipts, exclude the amount in excess of

it, you must check the "yes" box in the signa-

covered by the return, Account ID Number,

15% of those receipts.

ture area of the return. This authorization ap-

and Employer Identification Number or So-

plies only to the individual whose signature

cial Security Number.

Amounts received by a garage or parking lot

appears in the "Preparer's Use Only" section

operator for allowing the parking of a vehi-

of your return. It does not apply to the firm,

LINE 2 - GROSS RENT PAID

cle anywhere on his premises is not de-

if any, shown in that section. By checking the

Determine amount of gross rent paid for

ductible unless:

"Yes" box, you are authorizing the Depart-

each premises and enter on this line (Refer

ment of Finance to call the preparer to answer

to “What Constitutes Rent”, page 2.) If your

a)

a particular space has been permanently

any questions that may arise during the pro-

gross rent is based on a percentage of sales

assigned for the exclusive use of the

cessing of your return. Also, you are author-

receipts, exclude the excess of 15% of those

tenant; and

izing the preparer to:

receipts. If you rent an entire apartment,

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6