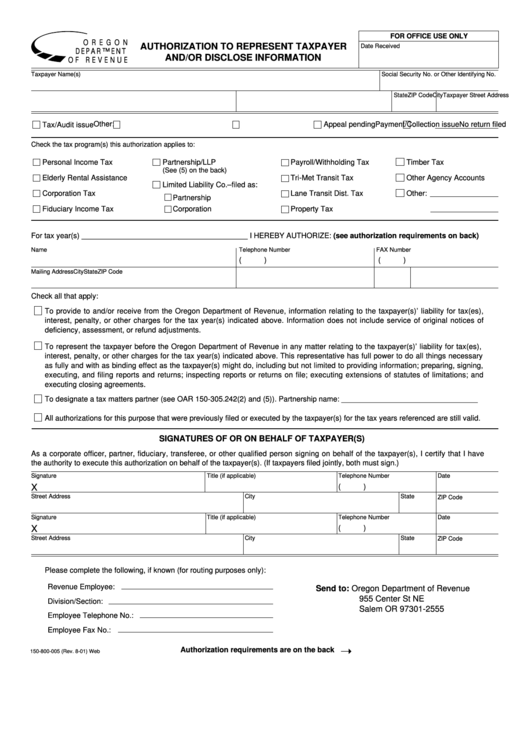

Form 150-800-005 - Authorization To Represent Taxpayer And/or Disclose Information - Oregon Department Of Revenue

ADVERTISEMENT

FOR OFFICE USE ONLY

O R E G O N

AUTHORIZATION TO REPRESENT TAXPAYER

Date Received

D E PA R T M E N T

AND/OR DISCLOSE INFORMATION

O F R E V E N U E

Taxpayer Name(s)

Social Security No. or Other Identifying No.

Taxpayer Street Address

City

State

ZIP Code

Payment/Collection issue

No return filed

Appeal pending

Other:

Tax/Audit issue

Check the tax program(s) this authorization applies to:

Personal Income Tax

Partnership/LLP

Payroll/Withholding Tax

Timber Tax

(See (5) on the back)

Elderly Rental Assistance

Tri-Met Transit Tax

Other Agency Accounts

Limited Liability Co.–filed as:

Corporation Tax

Lane Transit Dist. Tax

Other:

Partnership

Fiduciary Income Tax

Corporation

Property Tax

For tax year(s) _______________________________________ I HEREBY AUTHORIZE: (see authorization requirements on back)

Name

Telephone Number

FAX Number

(

)

(

)

Mailing Address

City

State

ZIP Code

Check all that apply:

To provide to and/or receive from the Oregon Department of Revenue, information relating to the taxpayer(s)’ liability for tax(es),

interest, penalty, or other charges for the tax year(s) indicated above. Information does not include service of original notices of

deficiency, assessment, or refund adjustments.

To represent the taxpayer before the Oregon Department of Revenue in any matter relating to the taxpayer(s)’ liability for tax(es),

interest, penalty, or other charges for the tax year(s) indicated above. This representative has full power to do all things necessary

as fully and with as binding effect as the taxpayer(s) might do, including but not limited to providing information; preparing, signing,

executing, and filing reports and returns; inspecting reports or returns on file; executing extensions of statutes of limitations; and

executing closing agreements.

To designate a tax matters partner (see OAR 150-305.242(2) and (5)). Partnership name: ________________________________

All authorizations for this purpose that were previously filed or executed by the taxpayer(s) for the tax years referenced are still valid.

SIGNATURES OF OR ON BEHALF OF TAXPAYER(S)

As a corporate officer, partner, fiduciary, transferee, or other qualified person signing on behalf of the taxpayer(s), I certify that I have

the authority to execute this authorization on behalf of the taxpayer(s). (If taxpayers filed jointly, both must sign.)

Signature

Title (if applicable)

Telephone Number

Date

(

)

X

Street Address

City

State

ZIP Code

Signature

Title (if applicable)

Telephone Number

Date

(

)

X

Street Address

City

State

ZIP Code

Please complete the following, if known (for routing purposes only):

Revenue Employee:

Send to:

Oregon Department of Revenue

955 Center St NE

Division/Section:

Salem OR 97301-2555

Employee Telephone No.:

Employee Fax No.:

Authorization requirements are on the back

150-800-005 (Rev. 8-01) Web

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1