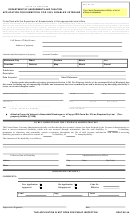

Form Sdat - Ex 1 - Application For Exemption Churches, Parsonages, Convents, Educational Buildings, And Church Cemeteries / Religious Corporation Articles Of Incorporation Page 3

ADVERTISEMENT

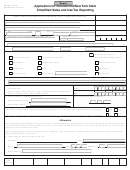

State of Maryland

Department of Assessments and Taxation

Charter Division

ARTICLES OF INCORPORATION FOR A TAX-EXEMPT RELIGIOUS CORPORATIONS

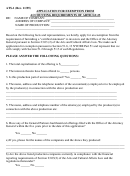

This type of corporation is appropriate only for incorporating a religious congregation which will be requesting tax-exempt

status. This guide is to be used with the form for Articles of Incorporation for a "Religious Corporation". Each item below describes

how to fill in the blank in the corresponding paragraph of the form.

You may fill in the blanks on the form and submit that as your Articles of Incorporation. If you have questions not answered

by this guide seek the advice of an attorney, accountant or other business advisor. Legal questions of a general nature cannot be

answered by the staff of this Department.

FIRST: Insert the names and addresses of at least four adult persons who have been elected by the congregation to create this

corporation. The only requirement is that they are at least 18 years old. The address should be one where mail can be received. It can

be anywhere.

SECOND: Insert the name of the corporation you will have. It must be distinguishable from all other corporations on record in

Maryland. To check name availability you may conduct an on line search at our website: , or you may call

the department at (410) 767-1330.

THIRD: Give a one or two sentence description of the purpose for which the corporation is being created. The description must

include the forming of a Congregation or place of worship.

FOURTH: The trustees are the people who run this corporation, so the elections which name or replace them are very important.

Any rule governing the election of trustees must be in the charter. This cannot be regulated by by-laws. These provisions should be

as specific as possible.

A. This should include the length of the terms of the trustees and exactly when elections are to be held. It should also describe

exactly how the election is to be run.

B. Any qualifications of who can be a trustee must be described here. Otherwise, any adult can be elected.

C. Any limitation of who can vote for trustees must be described here. Otherwise, any adult who attends the election may

vote.

FIFTH: Insert the address of the principal place of worship. This should be a place where mail can be delivered and must have a zip

code. A post office box will not be accepted unless a street address is also provided in this section.

SIXTH: This is the name and address of the individual designated to accept service of process if the corporation is summoned to

court for any reason. A person designated must be an adult citizen of Maryland or an existing Maryland corporation. The address

must include street, city and zip code. The address must be in Maryland and cannot be a post office box. This person must also sign

the document.

SEVENTH: 501 (c)(3) language.

EIGTH: All the individuals listed in FIRST and the resident agent in Article SIXTH must sign here.

FEES: The cost to file this is $120.00. Expedited processing which reduces turn around time is an additional $50.00. Fees for other

services may apply. Make checks payable to SDAT.

Room 801-301 West Preston Street – Baltimore, Maryland 21201

Phone: (410) 767-1350 – TTY Users call Maryland Relay

1-800-735-2258 Toll Free in MD: 1-888-246-5941 – website:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7