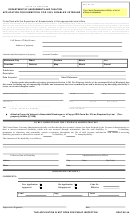

Form Sdat - Ex 1 - Application For Exemption Churches, Parsonages, Convents, Educational Buildings, And Church Cemeteries / Religious Corporation Articles Of Incorporation Page 4

ADVERTISEMENT

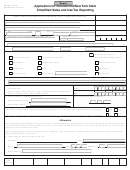

Maryland State Department of Assessments & Taxation

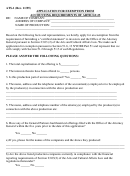

NOTES: Due to the fact that the laws governing the formation and operation of business entities and the

effectiveness of a UCC Financing Statement involves more than filing documents with our office, we suggest you

consult an attorney, accountant or other professional. State Department of Assessments & Taxation staff cannot

offer business counseling or legal advice.

Regarding annual documents to be filed with the Department of Assessments & Taxation: All domestic and foreign

legal entities must submit a Personal Property Return to the Department. Failure to file a Personal Property Return

will result in forfeiture of your right to conduct business in Maryland

Where and how do I file my documents?

By mail or in-person submissions should directed to:

State Department of Assessments and Taxation, Charter Division

301 W. Preston Street; 8th Floor

Baltimore, MD 21201-2395

All checks must be made out to State Department of Assessments and Taxation. The cost to file

documents should be included with the form. Also a schedule of filing fees is available online,

Online business registration and document filing via the Maryland EGov Business portal. See the l

Maryland Business Express link on homepage at

The Department of Assessments and Taxation no longer accepts via facsimile (fax) corporate

documents for filing or document copy request.

How long will it take to process my documents?

Regular document processing time is 4- 6 weeks.

Expedited processing request will be handled within 7 business days. The expedited service fee is an

additional $50.00 for each document; other fees may also apply.

Hand-delivered documents in limited quantities receive same day expedited service between 8:30 a.m.

and 4:30 p.m., Monday through Friday. You must be in line no later than 4:15 p.m. in order to receive

service that same day.

Online filed document are considered expedited will be processed within 7 business days.

Revised: April 2017

If applicable please fill out and submit to your local Assessment office the attached

exemption application for property owned by religious organizations.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7