Form Sdat - Ex 1 - Application For Exemption Churches, Parsonages, Convents, Educational Buildings, And Church Cemeteries / Religious Corporation Articles Of Incorporation Page 5

ADVERTISEMENT

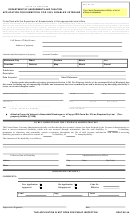

STATE OF MARYLAND

RETURN TO:

DEPARTMENT OF ASSESSMENTS AND TAXATION

APPLICATION FOR EXEMPTION

CHURCHES, PARSONAGES, CONVENTS,

EDUCATIONAL BUILDINGS, AND CHURCH CEMETERIES

TO BE FILED with the Supervisor of Assessments in the appropriate local office.

Applications must be received no later than September 1 in order to have the exemption considered for the current tax

levy. Applications received after September 1 will be considered for the next tax levy.

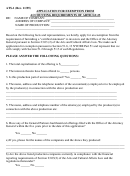

This form seeks information for the purpose of a church exemption on the indicated property. Failure to provide this information will result in denial of your application. However,

some of this information would be considered a "personal record" as defined in State Government Article, §10-624. Consequently, you have the statutory right to inspect your file

and to file a written request to correct or amend any information you believe to be inaccurate or incomplete. Additionally, personal information provided to the State Department of

Assessments and Taxation is not generally available for public review. However, this information is available to officers of the State, county or municipality in their official capacity

and to taxing officials of any State or the federal government, as provided by statute. Additionally, if your property would be used by the State Department of Assessments and Taxation

as a comparable for purposes of establishing the value of another property in a hearing before the Maryland Tax Court, the requested information, or a portion thereof, may have to

be provided to the owner of that other property.

Full Name of Titled Owner:

Address of property:

Location and description of property:

Account Number

Baltimore City

Ward

Section

Block

Lot

Counties

District

Map

Block

Parcel

Subdivision

Description

Date Acquired

Deed Reference

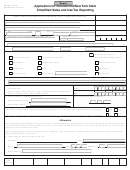

1.

Below, explain in sufficient detail the type and use of the property, land and buildings:

2.

Is any part of this property rented?

G

No G

Yes

If yes, to whom?

What is the estimated annual rent?

Does this organization own any adjoining Real Property?

3.

Yes G

No G

I declare under the penalties of perjury, pursuant to Section 1-201, Tax Property Article, of the Annotated Code of Maryland, that

this return (including any accompanying schedules and statements) has been examined by me and to the best of my knowledge and belief is

a true, correct and complete return.

SIGNATURE OF APPLICANT

DATE

ADDRESS

PHONE

CITY

STATE

ZIP CODE

(FOR OFFICE USE ONLY)

COMMENTS:

G

Re-Application G

New Application

Code No.

G

G

Approved

Disapproved

Effective

Land

Imp

Total

Supervisor's Signature

Date

THIS APPLICATION IS NOT OPEN FOR PUBLIC INSPECTION

SDAT - EX 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7