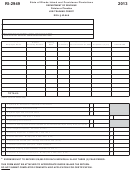

Form Ri-1040 - Rhode Island Tax Computation Worksheet - 2013 Page 2

ADVERTISEMENT

EXTENSION OF TIME

be credited to your estimated tax liability for 2014. No other application for

refund is necessary. Please note that no refund can be made unless your

Any extension of time granted for filing an individual income tax return

return is properly signed.

shall not operate to extend the time for the payment of any tax due on such

return.

Refunds of less than $1.00 will not be paid unless specifically requested.

In General -

(1) An individual who is required to file a Rhode Island income tax

See “Where and When to File” for mailing instructions.

return shall be allowed an automatic six month extension of time to file

such return.

REFUND CLAIMS

(2) An application must be prepared in duplicate on form RI-4868.

(3) The original of the application must be filed on or before the date

RIGL 44-30-87 provides different time periods within which a refund claim

prescribed for the filing of the return of the individual with the Rhode

is allowed. A refund may be claimed within three (3) years of filing a return

Island Division of Taxation.

or two (2) years from the time the tax was paid, whichever expires later.

(4) Such application for extension must show the full amount prop-

If a claim is made within the three (3) year period, the amount of the refund

erly estimated as tax for such taxpayer for such taxable year, and such

cannot exceed the amount of tax paid within that three (3) year period.

application must be accompanied by the full remittance of the amount

If a claim is made within the two (2) year period, the amount of refund

properly estimated as tax which is unpaid as of the date prescribed for

may not exceed the portion of tax paid during the two (2) years preceding

the filing of the return.

the filing of the claim.

NOTE: If no payment is required to be made with your Rhode Island exten-

sion form and you are filing a federal extension form for the same period of

For purposes of this section, any income tax withheld from the taxpayer

time, you do not need to submit the Rhode Island form. Attach a copy

during any calendar year and any amount paid as estimated income tax for

of Federal Form 4868 or the electronic acknowledgement you receive from

a taxable year is deemed to have been paid on the fifteenth day of the fourth

the IRS to your Rhode Island individual income tax return at the time it is

month following the close of the taxable year for which the payments were

submitted.

being made.

Filing for an extension of time to file Form RI-1040 does not extend the time

For more information, call the Personal Income Tax Section at

to file Form RI-1040H, Rhode Island Property Tax Relief Claim or Form RI-

(401) 574-8829, option #3.

6238, Rhode Island Residential Lead Paint Credit. These forms must be

filed by April 15, 2014.

SIGNATURE

You must sign your Rhode Island income tax return. If filing a joint return,

WHERE TO GET FORMS

both married individuals must sign the return. An unsigned return cannot

Forms may be obtained by:

be processed.

- visiting the Division of Taxation’s website: or

Any paid preparer who prepares a taxpayer’s return must also sign as

- calling the Division of Taxation’s Forms Request line: (401) 574-8970

“preparer”. If a firm or corporation prepares the return, it should be signed

in the name of the firm or corporation.

MISSING OR INCORRECT FORM W-2

If you wish to allow the Tax Division to contact your paid preparer should

This form is given to you by your employer showing the amount of income

questions arise about your return, check the appropriate box above the pre-

tax withheld on your behalf by your employer. A copy of it must accompany

parer’s name.

your Rhode Island income tax return if you are to receive credit for such

withheld tax. Only your employer can issue or correct this form. If you

NET OPERATING LOSS DEDUCTIONS

have not received a Form W-2 from your employer by February 15, 2014 or

The Rhode Island Personal Income Tax law relating to Net Operating Loss

if the form which you have received is incorrect, contact your employer as

deduction (NOL) has been amended by enactment of RIGL §44-30-2.8 and

soon as possible.

RIGL §44-30-87.1.

Under the provisions of RIGL §44-30-87.1, for losses incurred for taxable

CHANGES IN YOUR FEDERAL TAXABLE INCOME OR FED-

years beginning on or after January 1, 2002, an NOL deduction may not be

ERAL TAX LIABILITY

carried back for Rhode Island personal income tax purposes, but will only

You must report to the Rhode Island Division of Taxation any change or

be allowed as a carry forward for the number of succeeding years as pro-

correction in federal taxable income or federal tax liability as reported on

vided in IRS §172. A carry forward can only be used on the Rhode Island

your federal income tax return, whether resulting from the filing of an

return to the extent that the carry forward is used on the federal return.

amended federal return or otherwise. Such report must be made within 90

Should you have any questions regarding this matter, please call the Per-

days after filing an amended federal return or final determination of such

sonal Income Tax Section at (401) 574-8829, option #3.

change by the Internal Revenue Service. Use Form RI-1040X-R to report

any changes.

BONUS DEPRECIATION

A bill passed disallowing the new federal bonus depreciation for Rhode

RHODE ISLAND LOTTERY PRIZES

Island tax purposes. When filing a Rhode Island tax return any bonus de-

Winnings and prizes received from the Rhode Island Lottery are taxable

preciation taken for federal purposes must be added back to income as a

under the Rhode Island personal income tax law and are to be included in

modification on RI Schedule M, line 1d for Rhode Island purposes. In sub-

the income of both residents and nonresidents alike.

sequent years, when federal depreciation is less than what previously would

have been allowed, the difference may be deducted from income as a mod-

ESTIMATED INCOME TAX PAYMENTS

ification on RI Schedule M, line 2 for Rhode Island purposes.

If a taxpayer can reasonably expect to owe more than $250 after allowing

for withholding tax and/or credits, he or she must make estimated tax pay-

A separate schedule of depreciation must be kept for Rhode Island pur-

ments. Estimated tax payments are made on Form RI-1040ES that has in-

poses. The gain or loss on the sale or other disposition of the asset is to be

structions for computing the estimated tax and making payments.

determined, for Rhode Island purposes, using a Rhode Island depreciation

schedule.

PAYMENTS OR REFUNDS

EXAMPLE: A company bought equipment after September 11, 2001 that

cost $10,000 and had a 10 year life and qualified for 30% bonus deprecia-

Any PAYMENT of tax liability shown on your return to be due the State of

tion. Depreciation for federal purposes in the first year was $3,700 (30% X

Rhode Island must be paid in full with your return. Complete and submit

$10,000) + (10% x 7,000). Normal depreciation in the first year would have

Form RI-1040V with your payment.

been $1,000. The Company should add back on RI Schedule M, line 1d the

amount of $2,700 ($3,700 - $1,000). In subsequent years the company

An amount due of less than one dollar ($1) need not be paid.

should deduct $300 ($1000 - $700) each year while depreciation lasts. The

deduction should be on RI Schedule M, line 2 .

See “Where and When to File” for mailing instructions.

If a taxpayer has already filed a return, Form RI-1040X-R should be filed.

Questions on this procedure should be addressed by calling the Personal

A REFUND will be made if an overpayment of income tax is shown on

Income Tax Section at (401) 574-8829, option #3.

your return, unless you indicate on your return that such overpayment is to

Page I-2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8