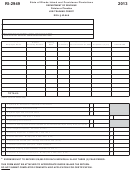

Form Ri-1040 - Rhode Island Tax Computation Worksheet - 2013 Page 5

ADVERTISEMENT

RI Schedule W, along with your W-2s and 1099s, must be attached to your

Line 18 - Overpayment to be applied to 2014:

return in order to receive credit for Rhode Island income tax withheld.

Enter the amount of overpayment from line 16 which is to be applied to your

2014 estimated tax. (See General Instructions on page I-2)

NOTE: You can not claim Rhode Island Temporary Disability Insurance pay-

ments (RI TDI or SDI) as income tax withheld. These amounts are non re-

fundable on Form RI-1040.

RI SCHEDULE I

Line 14b – 2013 Estimated Payments and Amount Applied from 2012

ALLOWABLE FEDERAL CREDIT

Return: Enter the amount of estimated payments paid on 2013 Form RI-

1040ES and the amount of overpayment applied from your 2012 return.

Line 19 – Rhode Island Income Tax: Enter the amount from Form RI-1040,

page 1, line 8.

Line 14c – Property Tax Relief Credit: Enter the amount of allowable prop-

erty tax relief credit from Form RI-1040H line 7 or 14, whichever is applica-

Line 20 – Credit for Child and Dependent Care Expenses: Enter the

ble. If you are filing a Rhode Island Form RI-1040, attach Form RI-1040H

amount from Federal Form 1040, line 48 or 1040A, line 29.

to the front of your RI-1040. However, if you are not required to file a Form

RI-1040 or if you are filing an extension for your RI-1040, you may file Form

Line 21 – Multiply the amount on line 20 by 25%

RI-1040H separately to claim your property tax relief credit. Filing an exten-

sion of time to file Form RI-1040 does NOT extend the time to file Form RI-

Line 22 - Maximum Credit: Enter the amount from line 19 or 21, whichever

1040H.

is less. Enter here and on form RI-1040, page 1, line 9a.

Form RI-1040H, Rhode Island Property Tax Relief Claim, must be filed

by April 15, 2014.

Line 14d – RI Earned Income Credit: Enter amount from page 2, RI Sched-

RI SCHEDULE II

ule EIC, line 46. If you are claiming a Rhode Island earned income credit,

CREDIT FOR INCOME TAXES PAID TO ANOTHER STATE

you must complete and attach RI Schedule EIC located on page 2 to your

RI-1040.

RIGL §44-30-18

If you are claiming credit for income taxes paid to more than one

Line 14e - RI Residential Lead Paint Credit: Enter the amount from Form

state, use Form RI-1040MU, Credit for Income Taxes Paid to Multiple

RI-6238, line 7. You must attach a copy of Form RI-6238 to your RI-1040.

States. Enter the applicable amounts from Form(s) RI-1040MU onto this

However, if you are not required to file a Form RI-1040 or if you are filing an

schedule.

extension for your RI-1040, you may file Form RI-6238 separately to claim

your RI Residential Lead Paint Credit. Filing an extension of time to file

Line 23 – Rhode Island Income Tax: Enter the amount from page 1, line 8

Form RI-1040 does NOT extend the time to file Form RI-6238.

less allowable federal credit from page 2, RI Schedule I, line 22.

Form RI-6238, Rhode Island Residential Lead Paint Credit, must be filed

by April 15, 2014.

Line 24 – Income from Other State(s): Enter the amount of income derived

from other state.

Line 14f – Other Payments: Enter any other payments and any advance

If state income tax has been paid to more than one other state, prepare a

payments made with your application for an automatic extension of time to

separate calculation for each state on Form RI-1040MU. Enter the amount

file (Form RI-4868). Attach a copy of Form RI-4868 to your return and check

of income from other states from Form RI-1040MU, line 29.

the box on Form RI-1040, page 1 to the right of line 14.

If you need to use more than one Form RI-1040MU, add all of the Form RI-

Any pass-through withholding from Form RI- 1099PT must be entered

1040MU line 29 amounts together and enter the total amount on line 24.

on RI Schedule W and Form RI-1099PT must be attached to your re-

Out-of-state gross income is determined in the same manner as that which

turn.

would be used for Federal purposes and generally includes the net amounts

of income that appear on the face of the other state's return or what would

Line 14g – Total Payments and Credits: Add lines 14a, 14b, 14c, 14d, 14e

be comparable to the face of the Federal Income Tax Return.

and 14f.

Line 25 – Modified Federal AGI: Enter amount from page 1, line 3.

Line 15a – Balance Due: If the amount on line 13 is greater than the amount

of line 14g, SUBTRACT line 14g from line 13 and enter the balance due on

Line 26 – Divide line 24 by line 25.

this line. This is the amount you owe.

Line 27 – Tentative Credit: Multiply the amount on line 23 by the percent-

Line 15b – Underestimating Interest Due: Complete Form RI-2210 or

age on line 26.

Form RI-2210A. Enter the amount of interest due from Form RI-2210, line

12 or line 22 or Form RI-2210A, line 12 on this line. This amount should be

Line 28 – Tax Due and Paid to Other State: Enter the amount of income

added to line 15a or subtracted from line 16, whichever applies.

tax due and paid to the other state and write the name of the state in the

space provided.

Line 15c – Total Amount Due: Add lines 15a and 15b. This amount is

payable in full with your return. Complete Form RI-1040V. Send payment

If state income tax has been paid to more than one other state, prepare a

and Form RI-1040V with your return. An amount due of less than one dollar

separate calculation for each state, on Form RI-1040MU. Enter the amount

($1) need not be paid.

of credit from Form RI-1040MU, line 30.

Line 16 – Overpayment: If the amount on line 14g is greater than the

amount on line 13 then SUBTRACT line 13 from line 14g and enter the over-

If you need to use more than one Form RI-1040MU, add all of the Form RI-

payment on line 16.

1040MU line 30 amounts together and enter the total amount on line 28.

If there is an amount due on line 15b for underestimating interest, subtract

In the space provided for the name of state to which income taxes were due

and paid enter “MU”.

line 15b from line 16.

If the amount of underestimating interest on line 15b is more than the amount

NOTE: You must attach a signed copy of the return filed with the other

of overpayment from line 16, subtract line 16 from line 15b and enter the re-

state(s). If you owe no tax to the other state(s) and are to be refunded

sult on line 15c.

all the taxes withheld or paid to the other state(s), enter $0.00 on line

28. If included on a composite filing in another state(s), you must at-

Line 17 – Refund: Enter the amount of the overpayment from line 16 that

tach a copy of the composite filing(s) showing your income and the

is to be refunded. Refunds of less than $1.00 will not be paid unless specif-

taxes paid on your behalf.

ically requested.

Page I-5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8