Form Ri-1040nr - Rhode Island Tax Computation Worksheet - 2013 Page 10

ADVERTISEMENT

Line 3 - Motion Picture Production Tax Credits or Musical and Theatri-

RI SCHEDULE CR

cal Production Tax Credits - RI-8201 - for certified production costs as de-

OTHER RI CREDITS

termined by the Rhode Island Film and Television Office or the Division of

Taxation.

The original certificate must be attached to the return.

Any

unused credit amount may be carried forward for three (3) years. RIGL §44-

CURRENT YEAR OTHER RI CREDITS:

31.2 and RIGL §44-31.3.

This credit schedule details “Other Rhode Island Credit(s)” being used on

Line 4 - TOTAL CREDITS - Add lines 1, 2 and 3. Enter the total here and

your RI-1040NR. Each Rhode Island credit has its own line. On the appro-

on Form RI-1040NR, page 1, line 12.

priate line, enter the dollar amount of the credit being taken. The total of all

credits will be entered on Form RI-1040NR, page 1, line 12.

RECAPTURE OF OTHER RI CREDITS:

Proper documentation must be submitted for each credit you are using

I

f a Rhode Island credit amount must be recaptured, enter the credit num-

or carrying forward.

ber, the credit name, and the amount of the credit to be recaptured in the

space provided on lines 5 and 6.

If you are using amounts carried forward from prior years, attach a schedule

showing the year of credit origination and any amounts used to date.

Line 7 - TOTAL AMOUNT OF CREDIT TO BE RECAPTURED - Add lines

5 and 6. Enter here and on RI-1040NR, page 1, line 13b.

If you are using amounts passed through to you, attach documentation sup-

porting the credit given to the entity, as well as, documentation of your share

of the credit(s).

Any missing or incomplete documentation will cause a delay in processing

your return.

Pursuant to RIGL 44-30-2.6(c)(3)(E), only the following credits are

allowed as credits against Rhode Island Personal Income Tax. No

other credits can be allowed. This also pertains to any carry forward

of a credit that is not listed in this section.

If the credit you are trying to use is not listed on lines 1 through 3, that means

the credit is no longer allowed against personal income tax. Entering an

amount for an ineligible credit on one of these lines or on an attached state-

ment will delay the processing of your return and result in the disallowance

of the credit.

Line 1 - Tax Credits for Contributions to Scholarship Organizations -

RI-2276 - for business entities that make contributions to qualified scholar-

ship organizations. The entity must apply for approval of the tax credit and

will receive a tax credit certificate issued by the Division of Taxation.

The

original certificate must be attached to the return.

The credit must be

used in the tax year that the entity made the contribution. Unused amounts

CANNOT be carried forward. RIGL §44-62

Line 2 - Historic Structures - Tax Credit (Historic Preservation Invest-

ment Tax Credit) - RI-286B – for approved rehabilitation of certified historic

structures.

The original certificate must be attached to the return.

Any

unused credit amount may be carried forward for ten (10) years. RIGL §44-

33.2

Note: This credit is for holders of a Historic Preservation Investment

Tax Credit certificate received under the state’s Historic Structures pro-

gram only. This credit is NOT for owners of historic residences who

qualified under the Historic Homeownership Assistance Act - RIGL §44-

33.1.

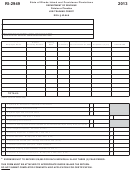

RHODE ISLAND TAX COMPUTATION WORKSHEET

Use for all filing status types

TAX

(b)

(c)

(d)

If Taxable Income-

(a)

Subtract (d) from (c)

Multiplication

Subtraction

Multiply (a) by (b)

RI-1040, line 7 or

Enter here and on

Enter the amount from

amount

amount

RI-1040NR, line 7 is:

RI-1040, line 8 or

RI-1040, line 7 or

RI-1040NR, line 8

RI-1040NR, line 7

Over

But not over

3.75%

$0.00

$0

$58,600

4.75%

$586.00

$58,600

$133,250

5.99%

$2,238.30

$133,250

Over

Page I-10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10