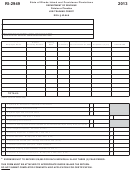

Form Ri-1040nr - Rhode Island Tax Computation Worksheet - 2013 Page 9

ADVERTISEMENT

Line 1d – Bonus depreciation that has been taken for federal purposes that

Line 2k – Allowable modification for performance based compensation re-

must be added back to Rhode Island income under RIGL §44-61-1 (See

alized by an eligible employee under the Rhode Island Jobs Growth Act

General Instructions on page I-3 for more details).

under RIGL §42-64.11-4.

Line 1e – Increased Section 179 depreciation that has been taken for fed-

Line 2l – Modification for exclusion for qualifying option under RIGL §44-

eral purposes that must be added back to Rhode Island income under RIGL

39.3 AND modification for exclusion for qualifying securities or investments

§44-61-1.1 (See General Instructions on page I-3 for more details).

under RIGL §44-43-8.

Line 1f – Recapture of Tuition Savings Program modifications (section 529

Line 2m – Modification for Tax Incentives for Employers under RIGL §44-

accounts) under RIGL §44-30-12(b)(4) (See General Instructions on page

55-4.1. Attach Form RI-107.

I-3 for more details).

Line 2n – Historic Structures - Tax Credit income, Motion Picture Production

Line 1g – Recapture of Historic Structures - Tax Credit or Motion Picture

Company Tax Credit or Musical and Theatrical Production Tax Credit income

Production Company Tax Credit under RIGL §44-33.2-3(e)(2) and RIGL §44-

reported on Federal return that is tax exempt under RIGL §44-33.2-3(e)(2),

31.2-9(5), respectively.

RIGL §44-31.2-9(c), and RIGL §44-31.3-2(b)(6), respectively.

Line 1h – Recapture of Scituate Medical Savings Account modifications

Line 2o – Active duty military pay of Nonresidents stationed in Rhode Island,

under RIGL §44-30-25.1(d)(3)(i).

as well as the income of their nonresident spouses for services performed

in Rhode Island. Income for services performed by the servicemember’s

Line 1i - Total Modifications Increasing Federal Adjusted Gross In-

spouse in Rhode Island would be exempt from Rhode Island income tax

come: Add lines 1a through 1h.

only if the servicemember’s spouse moves to Rhode Island solely to be with

the servicemember complying with military orders sending him/her to Rhode

Island. The servicemember and the servicemember’s spouse must also

Modifications Decreasing Federal AGI:

share the same non-Rhode Island domicile.

Not all income earned by the servicemember or his/her spouse is exempt

Line 2a – Income from obligations of the United States Government to the

extent included in adjusted gross income for federal tax purposes but exempt

from Rhode Island income tax. Non-military pay of the servicemember, as

for state purposes. However, this amount shall be reduced by any invest-

well as business income, gambling winnings or income from the ownership

ment interest incurred or continued on the obligation which has been taken

or disposition of real or tangible property earned from Rhode Island by either

as a federal itemized deduction. Example – US Government Series E bond

the servicemember or his/her spouse is still subject to Rhode Island income

interest. Taxpayers claiming these modifications must submit a schedule

tax.

showing the source and amount of income claimed to be exempt. RIGL §44-

30-12(c)(1)

Note: The military servicemember and/or his/her spouse may be asked to

submit proof of residency to support taking this modification.

Line 2b – Rhode Island fiduciary adjustment under RIGL §44-30-17. A fidu-

ciary adjustment is allowed for a beneficiary for income that maintains its char-

Line 2p – Contributions to a Scituate Medical Savings Account deemed tax-

acter as it flows from the fiduciary. For example, if the estate or trust has tax

able under the Internal Revenue Code, but tax exempt under RIGL §44-30-

exempt interest, the beneficiary would be allowed an adjustment for the tax ex-

25.1(d)(1).

empt interest and would list that fiduciary adjustment on this line.

Line 2q - Amounts of insurance benefits for dependents and domestic part-

Line 2c – Elective deduction for new research and development facilities

ners included in Federal adjusted gross income pursuant to chapter 12 under

under RIGL §44-32-1.

title 36 under §44-30-12(c)(6).

Line 2d – Railroad Retirement benefits included in gross income for federal

Line 2r - Rhode Island full-year residents only.

income tax purposes but exempt from state income taxes under the laws of

Up to $10,000 in unreimbursed expenses for travel, lodging and lost wages

the United States.

incurred by an individual as a result of the individual donating one or more

of his/her organs to another human being for organ transplantation under

Line 2e – Qualifying investment in a certified venture capital partnership

RIGL §44-30-12(c)(7). Modification can only be taken once during the life-

under RIGL §44-43-2.

time of the individual and is taken in the year that the human organ trans-

plantation occurs.

Line 2f – Family Education Accounts under RIGL §44-30-25(f).

Line 2s - Under RIGL §42-64.3-7 a domiciliary of an enterprise zone who

Line 2g – Tuition Saving Program (section 529 accounts) RIGL §44-30-

owns and operates a qualified business facility in that zone may, for the first

12(c)(4) - A modification decreasing federal adjusted gross income may be

three years after certification, reduce federal AGI by $50,000 per year and

claimed for any contributions made to a Rhode Island account under the tu-

may, for the fourth and fifth years, reduce federal AGI by $25,000 per year.

ition savings program. The maximum modification shall not exceed $500,

$1,000 if a joint return. (See General Instructions on page I-3 for more de-

Line 2t - Income from the discharge of business indebtedness deferred

tails).

under the American Recovery and Reinvestment Act of 2009 under §44-66-

1. When claimed as income on a federal tax return, this income may be re-

Line 2h – Exemptions from tax on profit or gain for writers, composers and

ported as a decreasing modification to federal adjusted gross income to the

artists residing within a section of the defined Economic Development Zone

extent it was previously included as Rhode Island income.

as defined in RIGL §44-30-1.1 within the cities of Newport, Providence, Paw-

tucket, Woonsocket or Warwick, or the Towns of Little Compton, Tiverton,

Line 2u – Total Modifications Decreasing Federal Adjusted Gross In-

Warren or Westerly and creating artistic works while a resident of the Zone.

come: Add lines 2a through 2t. Enter as a negative number.

Taxpayers claiming these modifications must submit a schedule showing the

source and amount of income claimed to be exempt.

Line 3 – Net Modifications to Federal Adjusted Gross income: Combine

lines 1i and 2t. Enter here and on Form RI-1040NR, page 1, line 2.

Line 2i – Depreciation that has not been taken for federal purposes because

of the bonus depreciation that must be subtracted from Rhode Island income

- RIGL §44-61-1. (See General Instructions on page I-3 for more details)

Line 2j – Depreciation that has not been taken for federal purposes because

of the increased section 179 depreciation was not taken originally - RIGL

§44-61-1.1. (See General Instructions on page I-3 for more details).

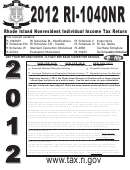

Page I-9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10