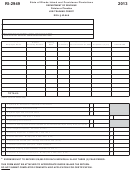

Form Ri-1040nr - Rhode Island Tax Computation Worksheet - 2013 Page 3

ADVERTISEMENT

NET OPERATING LOSS DEDUCTIONS

cation on Schedule M, line 2g.

If the funds are rolled over to a Tuition Savings Plan of another state or

The Rhode Island Personal Income Tax law relating to Net Operating Loss

are an unqualified withdrawal, recapture is required.

deduction (NOL) has been amended by enactment of RIGL §44-30-2.8 and

Taxpayers may also take a modification decreasing federal adjusted gross

RIGL §44-30-87.1

income in the amount of any qualified withdrawal or distribution from the “Tu-

Under the provisions of RIGL §44-30-87.1, for losses incurred for taxable

ition Saving Program” which is included in federal adjusted gross income.

years beginning on or after January 1, 2002, an NOL deduction may not be

Taxpayers should claim the modification on Schedule M, line 2g.

carried back for Rhode Island personal income tax purposes, but will only

be allowed as a carry forward for the number of succeeding years as pro-

RHODE ISLAND TAX CREDITS

vided in IRS Section 172. A carry forward can only be used on the Rhode

Island return to the extent that the carry forward is used on the federal re-

Rhode Island law provides special Rhode Island tax credits which may

turn.

be applied against the Rhode Island income tax. Before claiming any cred-

Should you have any questions regarding this matter, please call the Per-

its, taxpayers should refer to the Rhode Island law and/or regulations for

specific requirements for each credit such as carry over provisions and the

sonal Income Tax Section at (401) 574-8829, option #3.

order in which the credits must be used. Taxpayers claiming credits must

attach RI Schedule CR and the proper form(s) and other documentation to

BONUS DEPRECIATION

the return; failure to do so will result in disallowance of the credit. A list of

A bill passed disallowing the new federal bonus depreciation for Rhode

allowable Rhode Island credits is available on RI Schedule CR.

Island tax purposes. When filing a Rhode Island tax return any bonus de-

preciation taken for federal purposes must be added back to income as a

If you do not see a particular credit on RI Schedule CR, that means the

modification on RI Schedule M, line 1d for Rhode Island purposes. In sub-

credit is no longer allowed against personal income tax.

sequent years, when federal depreciation is less than what previously would

have been allowed, the difference may be deducted from income as a mod-

INTEREST

ification on RI Schedule M, line 2i for Rhode Island purposes.

Any tax not paid when due, including failure to pay adequate estimated

A separate schedule of depreciation must be kept for Rhode Island pur-

tax, is subject to interest at the rates of 18% (.1800) per annum.

poses. The gain or loss on the sale or other disposition of the asset is to be

determined, for Rhode Island purposes, using a Rhode Island depreciation

Interest on refunds of tax overpayments will be paid if the refund is not

schedule.

paid within 90 days of the due date or the date the completed return was

filed, whichever is later. The interest rate for tax overpayments is 3.25%

EXAMPLE: A company bought equipment after September 11, 2001 that

(.0325) per annum.

cost $10,000 and had a 10 year life and qualified for 30% bonus deprecia-

tion. Depreciation for federal purposes in the first year was $3,700 (30% X

PENALTIES

$10,000) + (10% x 7,000). Normal depreciation in the first year would have

The law provides for penalties in the following circumstances:

been $1,000. The Company should add back on RI Schedule M, line 1d the

•Failure to file an income tax return by the due date. A late filing penalty

amount of $2,700 ($3,700 - $1,000). In subsequent years the company

will be assessed at 5% (0.0500) per month on the unpaid tax for each month

should deduct $300 ($1000 - $700) each year while depreciation lasts. The

or part of a month the return is late. The maximum late filing penalty is 25%

deduction should be on RI Schedule M, line 2i.

(0.2500).

If a taxpayer has already filed a return, Form RI-1040X-NR should be filed.

•Failure to pay any tax due by the due date. A late payment penalty will

Questions on this procedure should be addressed by calling the Personal

be assessed at 1/2% (0.0050) per month on the unpaid tax for each month

Income Tax Section at (401) 574-8829, option #3.

or part of a month the tax remains unpaid. The maximum late payment

penalty is 25% (0.2500).

SECTION 179 DEPRECIATION

•Preparing or filing a fraudulent income tax return.

Rhode Island passed a bill disallowing the increase in the Section 179

depreciation under the Jobs & Growth Tax Relief Reconciliation Act of 2003.

Legislation passed in July of 2013 allows the tax administrator, upon

Section 179 depreciation will remain limited to $25,000 for Rhode Island in-

promulgation of an applicable regulation, to assess penalties on pre-

come tax purposes. When filing your Rhode Island tax return any additional

parers of tax filings. More information will be provided in regulations

Section 179 depreciation taken must be added back to federal adjusted

in the upcoming year.

gross income as a modification on RI Schedule M, line 1e. In subsequent

years, when federal depreciation is less than what previously would have

USE OF FEDERAL INCOME TAX INFORMATION

been allowed, the difference may be deducted from federal adjusted income

All amounts reported from the Federal Form 1040, 1040A, 1040EZ,

as a modification RI-1040, Schedule M, line 2j.

1040NR and 1040NR-EZ, as well as those reported on Form RI-1040NR

A separate schedule of depreciation must be kept for Rhode Island pur-

are subject to verification and audit by the Rhode Island Division of Taxa-

poses. The gain or loss on the sale or other disposition of the asset is to be

tion.

determined, for Rhode Island purposes, using the Rhode Island depreciation

The Rhode Island Division of Taxation and the Internal Revenue Service

schedule.

exchange income tax information to verify the accuracy of the information

Legislation passed in July of 2013, sets Rhode Island to conform with the

reported on Federal and Rhode Island income tax returns.

federal Section 179 deduction amounts for all assets placed in service on

or after January 1, 2014.

OTHER QUESTIONS

TUITION SAVINGS PROGRAM – SECTION 529

Obviously the foregoing general instructions and the specific instructions

A modification decreasing federal adjusted gross income may be

for completing the return form(s) which follow will not answer all questions

claimed for contributions made to a Rhode Island “qualified tuition pro-

that may arise. If you have any doubt regarding completion of your return,

gram" under section 529 of the Internal Revenue Code, 26 U.S.C. §529.

further assistance may be obtained at the Division of Taxation, One Capitol

The maximum modification shall not exceed $500, $1,000 if a joint return,

Hill, Providence RI 02908-5801 or by calling the Personal Income Tax Sec-

regardless of the number of accounts. Taxpayers should claim the modifi-

tion at (401) 574-8829, option #3.

SPECIFIC LINE INSTRUCTIONS

NAME AND ADDRESS

ELECTORAL SYSTEM CONTRIBUTION

Complete the identification portion of the return, including your name and

You may designate a contribution of five dollars ($5) or ten dollars ($10)

social security number, your spouse’s name and social security number (if

if married and filing a joint return, to the account for the public financing of

applicable), address, daytime telephone number and your city or town of

the electoral system. The first two dollars ($2) or four dollars ($4) if married

legal residence.

and filing a joint return, up to a total of two hundred thousand dollars

($200,000) collectively for all parties and the nonpartisan account, shall be

allocated only to political parties which at the preceding general election,

Page I-3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10