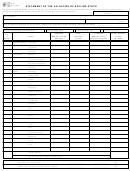

P r o p e r t y T a x

S t a t e m e n t o f I n c r e a s e / D e c r e a s e

Form 50-179

Schedule D – State Criminal Justice Mandate (For Counties)

________________________________

________________________________

The

County Auditor certifies that

County has spent

(county name)

(county name)

___________________

____________________

_________

$

in the previous 12 months beginning

,

, for the maintenance and operations

(amount)

(date)

____________________________________

cost of keeping inmates sentenced to the Texas Department of Criminal Justice.

County Sheriff has

(county name)

provided information on these costs, minus the state revenues received for reimbursement of such costs.

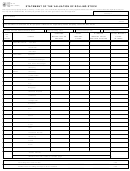

Schedule E – Transfer of Department, Function or Activity

______________________________

____________________________________

___________________

The

spent $

from

to

(name of taxing unit discontinuing the function)

(amount spent in the preceding 12 months before the rate calculations)

(beginning date)

___________________

________________________________

______________________________

on the

. The

operates this

(ending date)

(name of discontinuing function)

(name of taxing unit receiving the function)

______________________________

function in all or a majority of the

.

(name of taxing unit discontinuing the function)

[Second Year of Transfer: Modify schedule to show comparison of amount this year and preceding year by unit receiving the function.]

Schedule F – Enhanced Indigent Health Care Expenditures

______________________________

_________________

___________________

___________________

The

spent $

from

to

(name of taxing unit)

(amount)

(beginning date)

(ending date)

on enhanced indigent health care at the increased minimum eligibility standards, less the amount of state assistance. For the current tax year, the amount of

_________________

increase above last year’s enhanced indigent health care expenditures is $

.

(amount of increase)

This notice contains a summary of actual effective and rollback tax rates’ calculations.

:

You can inspect a copy of the full calculations at

_________________________________________________________________

Insert address

_________________________________________________________________

Name of person

_________________________________________________________________

preparing this notice

_________________________________________________________________

Title

_________________________________________________________________

Date prepared

For more information, visit our Web site:

Page 2 • 50-179 • 05-11/5

1

1 2

2