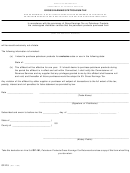

Deductions for Petroleum Products Gross Earnings Tax Return

Of the amount on Line 4, enter the gross earnings from fi rst sales to another who resells the products

15

15

$

outside of Connecticut as reported on Form OP-218. (Attach copy of each OP-218.)

Of the amount on Line 4, enter the gross earnings from fi rst sales to another who resells the products

16

16

$

exclusively outside Connecticut as reported on Form OP-219. (Attach copy of each OP-219.)

Of the amount reported on Line 4, enter the gross earnings from fi rst sales of No. 6 fuel oil used

17

17

$

exclusively by a company in SIC code classifi cations 2000 to 3999 or in Sector 31, 32, or 33 of the

NAICS manual.

Of the amount reported on Line 4, enter the gross earnings from fi rst sales of No. 2 heating oil used

18

18

$

exclusively in a vessel primarily engaged in interstate commerce.

Of the amount reported on Line 4, enter the gross earnings from fi rst sales of No. 2 heating oil

19

19

$

to be used exclusively for heating purposes.

Of the amount reported on Line 4, enter the gross earnings from fi rst sales of No. 2 heating oil

20

20

$

to be used in a commercial fi shing vessel.

Of the amount reported on Line 4, enter the gross earnings from fi rst sales of kerosene delivered by

21

21

$

a metered truck to a residential dwelling.

Enter the amount from Form OP-161, Schedule A, line 3, column C or Form OP-161, Schedule B,

22

22

$

line 3, column C.

Of the amount reported on Line 4, enter the gross earnings from fi rst sales of propane used

23

23

$

exclusively for heating purposes.

Of the amount reported on Line 4, enter the gross earnings from fi rst sales of propane gas to be used

24

24

$

as a fuel for a school bus.

Of the amount reported on Line 4, enter the gross earnings from fi rst sales of paraffi n or microcrystalline

25

25

$

waxes and cosmetic grade mineral oil.

Of the amount reported on Line 4, enter the gross earnings from fi rst sales of bunker fuel oil, intermediate

26

26

fuel, marine diesel oil, and marine gas oil for use in any vessel having a displacement exceeding 4,000

$

dead weight tons.

Of the amount entered on Line 4, enter the gross earnings from the fi rst sale of a commercial heating

oil blend containing not less than 10% alternative fuels derived from agricultural produce, food waste,

27

27

$

waste vegetable oil, or municipal solid waste including but not limited to biodiesel or low sulfur dyed

diesel fuel.

Of the amount reported on Line 4, enter the gross earnings from any fi rst sale occurring on or after

28

28

July 1, 2007, of diesel fuel other than diesel fuel to be used in an electric generating facility to generate

$

electricity.

29

Total Deductions: Enter here and on Line 5 on the front of this return.

29

$

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of

my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to the Department

of Revenue Services (DRS) is a fi ne of not more than $5,000, or imprisonment for not more than fi ve years, or both. The declaration of a paid preparer

other than the taxpayer is based on all information of which the preparer has any knowledge.

Taxpayer signature

Title

Date

Print taxpayer name

Telephone number

Taxpayer SSN

Paid preparer signature

Preparer’s address

Preparer’s SSN or PTIN

Form OP-161 (Rev. 06/13)

Page 2 of 4

1

1 2

2 3

3 4

4