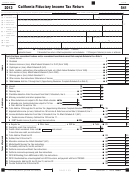

Instructions For Form 541 - California Fiduciary Income Tax Return - 2013 Page 11

ADVERTISEMENT

On Form 541, Side 2, line 39, enter the amount

Code 408, California Peace Officer Memorial

Code 426, American Red Cross, California

of the total voluntary contributions from the

Foundation Fund. Contributions will be used

Chapters Fund. Contributions will be used by

Voluntary Contributions, line 61.

to preserve the memory of California’s fallen

the American Red Cross, California Chapters for

peace officers and assist the families they left

planning and implementing programs for disaster

If there is an overpaid tax on Form 541, line 37,

behind. Since statehood, over 1,300 courageous

relief in California.

the amount contributed must be subtracted

California peace officers have made the ultimate

from the overpaid tax. If there is a tax due on

Line 61 – Total Voluntary Contributions

sacrifice while protecting law-abiding citizens.

Form 541, line 34, the total contributions must be

Add the amounts entered on Code 401 through

The non-profit charitable organization, California

added to the tax due.

Code 426. Enter the total on Form 541, Side 2,

Peace Officers’ Memorial Foundation, has

line 39. If no amounts are entered on Code 401

Code 401, Alzheimer’s Disease/Related

accepted the privilege and responsibility of

through Code 426, do not enter an amount on

Disorders Fund. Contributions will be used to

maintaining a memorial for fallen officers on the

Form 541, line 39.

provide grants to California scientists to study

State Capitol grounds. Each May, the Memorial

Alzheimer’s disease and related disorders. This

Schedule A

Foundation conducts a dignified ceremony

research includes basic science, diagnosis,

honoring fallen officers and their surviving

Charitable Deduction

treatment, prevention, behavioral problems, and

families by offering moral support, crisis

care giving. With almost 600,000 Californians

counseling, and financial support that includes

California law generally follows federal law,

living with the disease and another 2 million

academic scholarships for the children of those

however, California does not conform to IRC 1202.

providing care to a loved one with Alzheimer’s,

officers who have made the supreme sacrifice. On

A trust claiming a charitable deduction, etc.,

our state is in the early stages of a major public

behalf of all of us and the law-abiding citizens of

under IRC Section 642(c) for the taxable year

health crisis. Your contribution will ensure

California, thank you for your participation.

must file the information return required by R&TC

that Alzheimer’s disease receives the attention,

Code 410, California Sea Otter Fund. The

Section 18635 on Form 541-A.

research, and resources it deserves. For more

California Coastal Conservancy and the

information, go to cdph.ca.gov and search for

California law follows federal law for charitable

Department of Fish and Game will each be

alzheimer.

contributions.

allocated 50% of the contributions. Contributions

Code 402, California Fund for Senior Citizens.

Attach a statement listing the name and address

allocated to the California Coastal Conservancy

Contributions will provide support for the

of each charitable organization to which your

will be used for research, science, protection,

California Senior Legislature (CSL). The CSL is

contributions totaled $3,000 or more.

projects, or programs related to the Federal Sea

made up of volunteers who develop statewide

Otter Recovery Plan or improving the nearshore

See the instructions for completing federal

senior related legislative proposals in areas of

ocean ecosystem, including program activities

Form 1041, Schedule A, Charitable Deduction.

health, housing, transportation, and community

to reduce sea otter mortality. Contributions

Schedule B

services to be presented to the State Legislature.

allocated to the Department of Fish and Game will

For more information go to .

be used to establish a sea otter fund within the

Income Distribution Deduction

department’s index coding system for increased

Code 403, Rare and Endangered Species

investigation, prevention, and enforcement action.

California law generally follows federal law.

Preservation Program. Contributions will be used

to help protect and conserve California’s many

Code 412, Municipal Shelter Spay-Neuter Fund.

Schedule P (541) must be completed if the estate

threatened and endangered species and the wild

Contributions will be used to provide grants to

or trust had an income distribution deduction.

lands that they need to survive, for the enjoyment

eligible municipal shelters to provide low cost or

Line 1 – If the amount on Side 1, line 17, is less

and benefit of you and future generations of

free spay-neuter services for dogs and cats.

than zero and the negative number is attributable

Californians.

Code 413, California Cancer Research Fund.

in whole or in part to the capital loss limitation

Code 404, State Children’s Trust Fund for the

Contributions will be used to provide research

rules under IRC Section 1211(b), then enter as

Prevention of Child Abuse. Contributions will

on cancer causes, detection and prevention, and

a negative number on Schedule B, line 1, the

be used to fund programs for the prevention,

provide education and support to cancer survivors.

lesser of the loss from Side 1, line 17, or the loss

intervention, and treatment of child abuse and

from Side 1, line 4. If the negative number is not

Code 419, Child Victims of Human Trafficking

neglect.

attributable to the capital loss on line 4, enter -0-.

Fund. Contributions will be used to fund, through

Code 405, California Breast Cancer Research

grants, eligible community-based organizations

Line 2 – Figure the adjusted tax-exempt interest

Fund. Contributions will fund research toward

that agree to provide services to minors who are

as follows:

preventing and curing breast cancer. Breast

victims of human trafficking.

From the amount of tax-exempt interest received,

cancer is the most common cancer to strike

Code 420, California YMCA Youth and

subtract the total of 1 and 2 below.

women in California. It kills 4,000 California

Government Fund. Contributions will be used to

1. The amount of tax-exempt interest, including

women each year. Contributions also fund

support civic education programs operated by

exempt interest dividends from qualified

research on prevention and better treatment, and

the YMCA Youth and Government Program, the

mutual funds, on Form 541, Schedule A, line 2.

keep doctors up-to-date on research progress.

African American Leaders for Tomorrow Program,

2. Any disbursements, expenses, losses, etc.,

For more about the research your contributions

the Asian Pacific Youth Leadership Project, and

directly or indirectly allocable to the interest

support, go to . Your contribution can

the Chicano Latino Youth Leadership Project.

(even though described as not deductible

help make breast cancer a disease of the past.

Code 421, California Youth Leadership Fund.

under R&TC Section 17280).

Code 406, California Firefighters’ Memorial

Contributions will be used to support the activities

Figure the amount of the indirect disbursements,

Fund. Contributions will be used for repair

of the California Youth Leadership Project for the

etc., allocable to tax-exempt interest as follows:

and maintenance of the California Firefighters’

purpose of promoting youth civic engagement.

Memorial on the grounds of the State Capitol.

1. Divide the total tax-exempt interest received

Code 422, School Supplies for Homeless

Ceremonies to honor the memory of fallen

by the total of all the items of gross income

Children Fund. Contributions will be used to

firefighters and to assist surviving loved ones,

(including tax-exempt interest) included in

provide school supplies and health-related

and for an informational guide detailing survivor

distributable net income.

products to homeless children.

benefits to assist the spouses/RDPs and children

2. Multiply the result by the total disbursements,

of fallen firefighters.

Code 424, Protect Our Coast and Oceans

etc., of the trust that are not directly

Fund. Contributions will be used for grants and

attributable to any items of income.

Code 407, Emergency Food for Families Fund.

programs that preserve, protect, or enhance

Contributions will be used to help local food

Include any nontaxable gain from installment

coastal resources and promote coastal and

banks feed California’s hungry. Your contribution

sales of small business stock sold prior to

marine educational activities for underserved

will fund the purchase of much-needed food

October 1, 1987, and includable in distributable

communities.

for delivery to food banks, pantries, and soup

net income.

kitchens throughout the state. The State

Code 425, Keep Arts in Schools Fund.

Line 3 – Include all capital gains, whether or not

Department of Social Services will monitor its

Contributions will be used by the Arts Council

distributed, that are attributable to income under

distribution to ensure the food is given to those

for the allocation of grants to individuals or

the governing instrument or local law. If the

most in need.

organizations administering arts programs for

amount on Schedule D (541), line 9, column (a) is

children in preschool through 12th grade.

a net loss, enter -0-.

Page 12 Form 541 Booklet 2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12