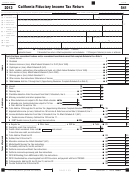

Instructions For Form 541 - California Fiduciary Income Tax Return - 2013 Page 4

ADVERTISEMENT

The authorization will automatically end no later

with an AGI greater than $150,000 are required

Late payment of tax. A penalty is assessed for

than the due date (without regard to extensions)

to estimate their tax based on the lesser of 110%

not paying tax by the due date unless there was

for filing the estate’s or trust’s 2014 tax return. If

of their 2012 year tax or 90% of their 2013 year

reasonable cause for not paying on time. The

the fiduciary wants to expand the paid preparer’s

tax, including AMT. Fiduciaries with an AGI equal

penalty is 5% of the unpaid tax plus one-half

authorization, see form FTB 3520, Power of

or greater than $1,000,000 must calculate their

of 1% for each month, or part of a month, that

Attorney Declaration for the Franchise Tax Board.

estimated tax on 90% of their 2013 year tax,

the tax is late, up to a maximum of 25%. We

If the fiduciary wants to revoke the authorization

including AMT.

may waive the late payment penalty based on

before it ends, notify the FTB in writing or call

reasonable cause. Reasonable cause is presumed

For more information, get Form 541-ES.

800.852.5711.

when 90% of the tax is paid by the original due

date of the return.

K Decedent’s Will and Trust

I

Where to File

If an estate or trust is subject to both the penalty

Instrument

for failure to file a timely tax return and the

Payments

penalty for failure to pay the total tax by the due

Do not file a copy of the decedent’s will or the

If an amount is due:

date, a combination of the two penalties may be

trust instrument unless the FTB requests one.

• Mail Form 541 with payment to:

assessed, but the total will not exceed 25% of the

L Limitations

Franchise Tax Board

unpaid tax.

PO BOX 942867

Penalty for failure to provide Schedule K-1

At-Risk Loss Limitations. Generally, the amount

Sacramento CA 94267-0001

(541). The fiduciary is required to provide a

the estate or trust has “at-risk” limits the loss

• e-filed tax returns: Mail form FTB 3843,

Schedule K-1 (541) to each beneficiary who

that may be deducted for any taxable year. Get

Payment Voucher for Fiduciary e-filed Returns,

receives a distribution of property or an allocation

federal Form 6198, At-Risk Limitations, to figure

with payment to:

of an item of the estate. A penalty of $50 per

the deductible loss for the year. Use California

beneficiary (not to exceed $100,000 for any

Franchise Tax Board

amounts.

calendar year) will be imposed on the fiduciary if

PO BOX 942867

Passive Activity Loss and Credit Limitations.

this requirement is not satisfied.

SACRAMENTO CA 94267-0008

IRC Section 469 (which California incorporates

If the estate or trust includes interest on any of

Using black or blue ink, write the estate’s or

by reference) generally limits deductions from

these penalties with the payment, identify and

trust’s federal employer identification number

passive activities to the amount of income derived

enter these amounts in the bottom margin of

(FEIN) and “2013 Form 541” on all payments. Do

from all passive activities. Similarly, credits from

Form 541, Side 1. Do not include the interest or

not mail cash.

passive activities are limited to tax attributable to

penalty in the tax due on line 34 or reduce the

such activities. These limitations are first applied

Make all checks or money orders payable in

overpaid tax on line 35.

at the estate or trust level. Get the instructions

U.S. dollars and drawn against a U.S. financial

for federal Form 8582, Passive Activity Loss

Other penalties. Other penalties may be assessed

institution.

Limitations, and federal Form 8582-CR, Passive

for a payment returned by the fiduciary’s bank for

If there is a refund or no amount is due, mail the

Activity Credit Limitations, for more information

insufficient funds, accuracy-related matters, and

tax return to:

on passive activities loss and credit limitation

fraud.

FRANCHISE TAX BOARD

rules. Get form FTB 3801-CR, Passive Activity

Underpayment of Estimated Tax Penalty.

PO BOX 942840

Credit Limitations, to figure the amount of credit

The underpayment of estimated tax penalty

SACRAMENTO CA 94240-0001

allowed for the current year.

shall not apply to the extent the underpayment

Private Delivery Service. California conforms

of an installment was created or increased

M Special Rule for Blind Trust

to federal law regarding the use of certain

by any provision of law that is chaptered

designated private delivery services to meet the

during and operative for the taxable year of

If the fiduciary is reporting income from

“timely mailing as timely filing/paying” rule for tax

the underpayment. To request a waiver of the

a qualified blind trust (under the Ethics in

returns and payments. See federal Form 1041 for

underpayment of estimated tax penalty, get form

Government Act of 1978), it should not identify

a list of designated delivery services. If a private

FTB 5805, Underpayment of Estimated Tax by

the payer of any income to the trust, but complete

delivery service is used, address the return to:

Individuals and Fiduciaries.

the rest of the tax return as provided in the

instructions. Also, write “BLIND TRUST” at the

FRANCHISE TAX BOARD

P Attachments

top of Form 541, Side 1.

SACRAMENTO CA 95827

If the estate or trust needs more space on the

Caution: Private delivery services cannot deliver

N Multiple Trust Rules

forms or schedules, attach separate sheets

items to PO boxes. If using one of these services

showing the same information in the same order

to mail any item to the FTB, DO NOT use an FTB

Two or more trusts are treated as one trust if the

as on the printed forms.

PO box.

trusts have substantially the same grantor(s) and

substantially the same primary beneficiary(ies),

Enter the estate’s or trust’s FEIN on each sheet.

J Estimated Tax Payments

and if the principal purpose of the use of

Also, use sheets that are the same size as the forms

multiple trusts is avoidance of tax. This provision

and schedules and indicate clearly the line number

Generally, estates and trusts are required to make

applies only to that portion of the trust that is

of the printed form to which the information

quarterly estimated tax payments if the estate or

attributable to contributions to corpus made after

relates. Show the totals on the printed forms.

trust expects to owe at least $500 in tax including

March 1, 1984.

alternative minimum tax (AMT), after subtracting

Q California Use Tax

withholding and credits. Estates and trusts, which

O Interest and Penalties

received the residue of the decedent’s estate, are

General Information

required to make estimated income tax payments

Interest. Interest will be charged on taxes not

The use tax has been in effect in California since

for any year ending two or more years after the

paid by the due date, even if the tax return is filed

July 1, 1935. It applies to purchases from out-of-

date of the decedent’s death.

by the extended due date. For more information,

state sellers and is similar to the sales tax paid

see General Information G, When to File.

The required annual tax payment is generally the

on purchases fiduciaries make in California. If

lesser of 100% of the prior year’s tax or 90% of

fiduciaries have not already paid all use tax due

Late filing of tax return. A penalty is assessed if

the current year’s tax. Estates and trusts must pay

to the State Board of Equalization, fiduciaries may

the tax return is filed after the due date (including

30% of their required annual payment for the first

report and pay the use tax due on its state income

extensions), unless there was reasonable cause

installment, 40% for the second, no estimated

tax return. See the information on the next page

for filing late. The penalty is 25% of the tax

payment for the third, and 30% for the fourth

and the instructions for line 38 of the fiduciary

liability if the tax return is filed after the extended

installment.

income tax return.

due date. If the tax return is filed more than 60

days after the extended due date, the minimum

Limit on Prior Year Tax. Fiduciaries with an

penalty is $135 or 100% of tax due on the tax

adjusted gross income (AGI) of $150,000 or

return, whichever is less.

less calculate their required estimated tax on the

lesser of 100% of the 2012 year tax, or 90% of

the 2013 year tax, including AMT. Fiduciaries

Form 541 Booklet 2013 Page 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12