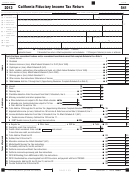

Instructions For Form 541 - California Fiduciary Income Tax Return - 2013 Page 3

ADVERTISEMENT

G When to File

• Form 1041-A, U.S. Information Return Trust

Trusts that hold assets related to an IRC

Accumulation of Charitable Amounts. Used to

Section 1361(d) election and other assets not

File Form 541 by the 15th day of the 4th month

report information on charitable contributions

related to an IRC Section 1361(d) election

following the close of the taxable year of the

as required by IRC Section 6034 and related

should provide its beneficiary or beneficiaries

estate or trust. For calendar year estates and

regulations

with separate Schedules K-1 (541). One for the

trusts, file Form 541 and Schedules K-1 (541) by

• Form 990PF, Return of Private Foundation, or

income and deductions from the assets related

April 15, 2014.

Section 4947(a)(1) Nonexempt Charitable Trust

to the IRC Section 1361(d) election and one for

Treated as a Private Foundation

the income and deductions from the other assets.

If Form 541 cannot be filed by the filing due date,

• Form 990T, Exempt Organization Business

The Schedule K-1 (541) for the income and

the estate or trust has an additional six months to

Income Tax Return (and proxy tax under

deductions for the IRC Section 1361(d) assets

file without filing a written request for extension.

Section 6033(e))

should include all of the trust’s items of income

However, to avoid late-payment penalties, the tax

• Form 706, U.S. Estate (and Generation-

and deductions from such assets. Write “QSST”

liability must be paid by the original due date of

Skipping Transfer) Tax Return, to figure estate

across the top of the Schedule K-1 (541).

the tax return. This also applies to REMICs that

tax imposed by Chapter 11 of the IRC on

are subject to an annual $800 tax. When the due

Substitute Schedule K-1 (541). If the estate or

the decedent’s estate. It also computes the

date falls on a weekend or holiday, the deadline

trust does not use an official FTB Schedule K-1

generation-skipping transfer tax imposed by

to file and pay without penalty is extended to the

(541) or a software program with an

Chapter 13

next business day.

FTB-approved Schedule K-1 (541), it must get

• Form 541, California Fiduciary Income Tax

approval from the FTB to use a substitute form.

If an extension of time to file is needed but an

Return

unpaid tax liability is owed, use form FTB 3563,

You may also be required to file one or more of

• Form 541-A, Trust Accumulation Of Charitable

Payment for Automatic Extension for Fiduciaries,

the following:

Amounts. Used to report a charitable or other

that is included in this tax booklet.

deduction under IRC Section 642(c), or for

• Form 540, California Resident Income Tax

If the tax return is not filed by the extended due

charitable or split-interest trust

Return

date, delinquent filing penalties and interest will

• Form 541-B, Charitable Remainder and Pooled

• Form 540NR, California Nonresident or

be imposed on any tax due from the original due

Income Trusts

Part-Year Resident Income Tax Return (Long or

date of the tax return.

• Form 109, California Exempt Organization

Short)

Business Income Tax Return

The 2013 Form 541 may be used for a taxable

• Form 541-A, Trust Accumulation of Charitable

• Form 199, California Exempt Organization

year beginning in 2014 if both of the following

Amounts

Annual Information Return

apply:

• Form 541-B, Charitable Remainder and Pooled

• The estate or trust has a taxable year of less

D Definitions

Income Trusts

than 12 months that begins and ends in 2014.

• Form 541-ES, Estimated Tax for Fiduciaries

• The 2014 Form 541 is not available by the

Get federal Form 1041, U.S. Income Tax Return

• Form 541-T, California Allocation of Estimated

time the estate or trust is required to file its tax

for Estates and Trusts, for information about any

Tax Payments to Beneficiaries

return. However, the estate or trust must show

of the following:

• Form 592, Resident and Nonresident

its 2014 taxable year on the 2013 Form 541

• Beneficiaries

Withholding Statement

and incorporate any tax law changes that are

• Fiduciaries

• Form 592-B, Resident and Nonresident

effective for taxable years beginning after

• Decedent’s estates

Withholding Tax Statement

December 31, 2013.

• Simple trusts

• Form 592-F, Foreign Partner or Member

A qualified settlement fund is treated as a

• Income required to be distributed currently

Annual Return

corporation for filing and reporting purposes

• Income, deductions, and credits in respect of a

• Form 593, Real Estate Withholding Tax

and should file its California income tax return

decedent

Statement

by the 15th day of the 3rd month following the

• Distributable net income (DNI)

• Schedule J (541), Trust Allocation of an

close of the taxable year, normally March 15th.

• Complex trusts

Accumulation Distribution

The corporation must attach a copy of the

• Bankruptcy estates

• Schedule P (541), Alternative Minimum Tax

federal Form 1120-SF, U.S. Income Tax Return

• Grantor-type trusts

and Credit Limitations – Fiduciaries

for Settlement Funds (under Section 468B), and

• Pooled income funds

• Form FTB 4800 MEO, Federally Tax

any statements or elections required by Treasury

Exempt Non-California Bond Interest and

E Additional Forms the

Regulations to Form 541.

Interest-Dividend Payments Information Media

Fiduciary May Have to File

Transmittal *

H Paid Preparer Authorization

• Federal Forms 1099-A, B, INT, LTC, MISC,

In addition to Form 541, the fiduciary must file a

If the fiduciary wants to allow the paid preparer to

MSA, OID, R, and S

separate Schedule K-1 (541) or an FTB-approved

discuss the 2013 tax return with the FTB, check

*Entities paying interest to California taxpayers

substitute for each beneficiary.

the “Yes” box in the signature area of the tax

on non-California municipal bonds that are held

return. Also print the paid preparer’s name and

Schedule K-1 (541) line items are similar to the

by California taxpayers, are required to report

telephone number.

federal Schedule K-1 (Form 1041), Beneficiary’s

interest payments aggregating $10 or more.

Share of Income, Deductions, Credits, etc. Refer

If the “Yes” box is checked, the fiduciary is

Information returns and form FTB 4800 MEO are

to the Schedule K-1 Federal/State Line References

due on or before June 3, 2014.

authorizing the FTB to call the designated paid

chart on page 31, and Specific Line Instructions

preparer to answer any questions that may arise

when completing Schedule K-1 (541).

F Period Covered by the Tax

during the processing of its tax return. The

fiduciary is also authorizing the paid preparer to:

Trusts that only hold assets related to an IRC

Return

Section 1361(d) election should include all of the

• Give the FTB any information that is missing

trust’s items of income and deductions on the

File Form 541 for calendar year 2013 or a fiscal

from the tax return.

Schedule K-1 (541) of the beneficiary who made

year beginning in 2013. Only trusts exempt from

• Call the FTB for information about the

the election and should write “QSST” across

taxation under IRC Section 501(a) or a charitable

processing of the tax return or the status of

the top of the Schedule K-1 (541) (the trust is

trust described under IRC Section 4947(a)(1)

any related refund or payments.

treated as a grantor trust with respect to such

and estates may have a fiscal year. If the fiduciary

• Respond to certain FTB notices about math

beneficiary).

does not file a calendar year tax return, it must

errors, offsets, and tax return preparation.

enter the taxable year in the space at the top of

The fiduciary is not authorizing the paid preparer

Form 541.

to receive any refund check, bind the estate or

For estates, the date of death determines the end

trust to anything (including any additional tax

of the decedent’s taxable year and the beginning

liability), or otherwise represent the estate or trust

of the estate’s taxable year. The first taxable year

before the FTB.

for the estate may be any period of 12 months or

less that ends on the last day of a month.

Page 4 Form 541 Booklet 2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12