Dealer In Intangibles Tax Return - 2011 Page 12

ADVERTISEMENT

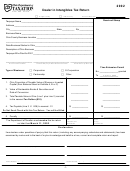

True Value Computation – Stand-Alone Computers

Form 937DI, True Value Computation, provides a consistent

placed in column 7. Total column 7 and that will be the fair

method for determining the aggregate fair value for dealers

value of the depreciable assets. Compare the total fair value

in intangibles’ total depreciable assets, company-wide, inside

of the depreciable assets to the book value of those same

and outside Ohio.

assets on the Dec. 31 balance sheet and place the increase

or decrease to fair value on line 2 in Exhibit A of form 980.

Costs of depreciable property at the end of the previous year

are to be shown by year of acquisition for the entire entity

For dealers in intangibles, depreciable property under this

(column 2). Additions and disposals occurring during the year

class life consists mainly of offi ce computers.

are to be entered at cost, across the year in which they were

Full costs must be shown. Cost column totals must reconcile

acquired (column 3, column 4). The resulting costs remaining

with ledger accounts, except that property written off the

at year-end are then listed (column 5); their total must equal

records but still physically on hand must be included in the

the beginning of the year total plus additions, less disposals.

computation, and properly disposed of but not written off the

The valuation percentages for the specifi ed class of property

records should be deducted. These exceptions should be

are listed in column 6. Each year-end cost is then multiplied

separately identifi ed in the computation.

by the corresponding valuation percentage and the product

Sample Computation for 2011 Return

Illustrating Application of Stand-Alone Computers

(1)

(2)

(3)

(4)

(5)

(6)

(7)

Cost at End

Additions

Disposals

Cost at End

Year

of

of

True Value

Acquired

12-31-09

12-31-10

Percent

Amount $

2010

$641,310

$641,310

75%

$480,983

2009

$434,040

434,040

60%

260,424

2008

$201,032

100,000

45%

301,032

45,000

2007

277,736

277,736

30%

83,321

2006

2,393,633

444,943

1,948,690

15%

292,304

2005 and prior

15%

Fair Value

=

$1,162,032

Total

3,406,441

$641,310

645,975

$3,401,776

Carry Total True Value to Summary Sheet.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20