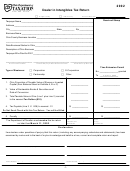

Dealer In Intangibles Tax Return - 2011 Page 5

ADVERTISEMENT

Venture capital tax credits may be claimed by a qualifying

Information

dealer in intangibles against its dealer in intangibles tax li-

Any question relative to the fi ling of the dealer in intangibles

ability. See R.C. 5725.19.

tax return or the procurement of forms must be addressed

to the Department of Taxation, Attn: Excise, Motor Fuel and

Ohio Historic Preservation Tax Credit

Public Utilities Tax Division, P.O. Box 530, Columbus, OH

Historic preservation tax credit may be claimed against the

43216-0530 or call 614-466-7371. Visit the department’s

dealer in intangibles tax liability. See R.C. 5725.151.

Web site at tax.ohio.gov for additional forms.

- 5 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20