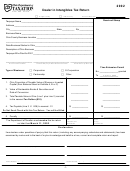

Dealer In Intangibles Tax Return - 2011 Page 3

ADVERTISEMENT

General Information and Instructions

Relating to Dealer in Intangibles Tax Return

Defi nition of a Dealer in Intangibles – R.C. 5725.01(B)

Payment of Tax

(1) “Dealer in intangibles” includes every person who keeps

No payment should be submitted with the return. For timely

an offi ce or other place of business in this state and engages

fi led and properly extended returns, a statement of tax due

at such offi ce or other place in a business that consists

will be issued by the Ohio Treasurer of State in early May.

primarily of lending money or discounting, buying or selling

Balance Sheet

bills of exchange, drafts, acceptances, notes, mortgages

The balance sheet on the reverse side of Ohio form 980

or other evidences of indebtedness, or of buying or selling

must be completed using a list date of Dec. 31st annually

bonds, stocks or other investment securities, whether on his

(R.C. 5725.14).

own account with a view to profi t, or as agent or broker for

others, with a view to profi t or personal earnings. “Dealer in

Consolidated Returns

intangibles” excludes institutions used exclusively for chari-

An incorporated dealer in intangibles who owns or controls

table purposes, insurance companies and fi nancial institu-

51% or more of the common stock of another incorporated

tions. The investment of funds as personal accumulations or

dealer in intangibles may by application request to fi le a

as business reserves or working capital does not constitute

consolidated return with the tax commissioner on or before

engaging in business within the meaning of this division; but

the second Monday in March. If the application is granted,

a person who, having engaged in the business that consists

all subsidiary dealers in intangibles of 51% or more must be

primarily of lending money, or discounting, buying or selling

included. When a consolidated return is fi led, it must include

bills of exchange, drafts, acceptances, notes, mortgages or

a list of the subsidiary dealers, FEIN, addresses and a con-

other evidences of indebtedness on his own account, remains

solidating balance sheet refl ecting all subsidiaries and the

in business for the purpose of realizing upon the assets of

intercompany eliminations (R.C. 5725.14).

such business is deemed a dealer in intangibles, though not

presently engaged in a business that consists primarily of

Exhibit A

lending money or discounting or buying such securities.

Exhibit A is used to adjust the net worth of the dealer to its

fair value at Dec. 31. Items such as fi xed assets, exchange

Filing Requirements

memberships, stocks, investments, real estate and accounts

All persons, partnerships, associations and corporations that

receivable are examples of items listed on the balance sheet

are engaged in business as a dealer in intangibles Jan. 1

that need to be calculated at their fair value at Dec. 31. These

must fi le a dealer in intangibles tax return. The return must

items are netted against their book value and the result placed

be fi led with the tax commissioner, Attn: Excise, Motor Fuel

on line 2. The net addition or reduction is added or deducted

and Public Utilities Tax Division, P.O. Box 530, Columbus,

from line 1. The result is the fair value, which is then carried

OH 43216-0530 no later than the second Monday of March,

to the front page of the return in the computation of tax sec-

or as properly extended. A tax return is fi led on the date the

tion line 3, rounded to the nearest $10.

tax commissioner receives it or on the postmark date if the

taxpayer fi les the tax by certifi ed mail or by use of an autho-

Exhibit B

rized delivery service. See R.C. 5703.056.

In the case of a dealer principally engaged in the business

of lending money or discounting loans, gross receipts will

Extension of Time

consist of the aggregate amount of loans effected, discounted

The tax commissioner may, upon verifi ed request and for

and renewed.

good cause shown, extend for a period not exceeding 30

days, the period during which a dealer in intangibles shall

Exhibit B is used to determine the Ohio percentage of busi-

fi le their Ohio form 980, R.C. 5725.10. A written request for

ness for dealers in intangibles who generate loan business

extension of time must be received at the address listed

both in the state of Ohio and everywhere. (Dealers who only

above or submitted via certifi ed mail no later than the second

operate within the state do not need to complete this section.)

Monday in March; be sure to include the proper business

The total amount of loan business conducted for the year in

name, address, account number and stated cause. If request-

Ohio is divided by the total of loan business for the year ev-

ing extensions for a consolidated return, each subsidiary and

erywhere. This percentage is then multiplied by the total from

their federal employer identifi cation number (FEIN) must be

line 3 of Exhibit A. This value is then forwarded to the front of

listed within the request.

the return (line 3) to compute the amount of tax due.

Penalty for Late Filing

Business may not be allocated within and without Ohio unless

As provided by R.C. 5725.17, a penalty may be assessed

the dealer maintains separate offi ce locations both within and

equal to the greater of $50 per month or fraction of a month,

without Ohio. Independent agents who solicit business out

not to exceed $500, or 5% per month or fraction of a month,

of Ohio and forward it to an Ohio offi ce must allocate that

not to exceed 50% of the tax required to be shown on the

portion to Ohio. Employees of the dealer who solicit business

return for each month or fraction of a month elapsing between

out of state but report to the Ohio offi ce must also allocate

the due date and the date on which the return is fi led.

all business to Ohio.

- 3 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20