Dealer In Intangibles Tax Return - 2011 Page 7

ADVERTISEMENT

2011

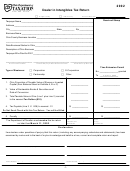

Form 980

Rev. 11/10

Dealer in Intangibles Tax Return

Consolidated

Single county

Inter-County

Account number

Check here if you are a “qualify-

Taxpayer name

ing dealer” (see R.C. 5725.24 and

5733.45). Generally, a qualifying

Address

dealer is a dealer in intangibles that

is a subsidiary of a fi nancial institu-

City

State

ZIP

tion or insurance company. If you are

a qualifying dealer, you do not need

Business name

to complete Ohio form 982.

Ohio county business location

Received Stamp

Date business started in Ohio

Description of Ohio business

Time Extension Permit

Ohio charter number

FEIN

Social Security number

No.

granted

April 13, 2011

Type of business:

Corporation

S corporation

Partnership

Other

To

1. Ohio proportion of taxable value of shares or invested capital (from Balance Sheet

or Exhibits A, B or C) ..........................................................................................................

$

2. Value of nontaxable bonds and securities as of date of conversion ..................................

$

3. Total taxable value in Ohio (line 1 plus line 2) rounded to the nearest $10 ......................

$

4. Tax payable (line 3 multiplied by .008) to nearest .01 ........................................................

$

5. Credit for eligible employee training costs .........................................................................

$

6. Venture capital tax credits

a. refundable credit ............................................................................................................

$

b. nonrefundable credit ......................................................................................................

$

7. Ohio historic preservation tax credit ...................................................................................

$

8. Total tax payable ................................................................................................................

$

Do not send a check with this tax return. You will be billed.

9. Penalty ..............................................................................................................................

$

The Department of Taxation must receive this tax return no later than March 14, 2011.

D.E. verifi cation

Declaration

I/we declare under penalties of perjury that this return (including any accompanying schedules and statements) has been

examined by me/us and to the best of my/our knowledge and belief is a true, correct and complete return and report.

Person, other than taxpayer, preparing this return Date

Signature of taxpayer

Title

Date

Address

Print name of taxpayer

Date

Phone number

Phone number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20