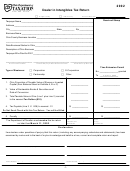

Dealer In Intangibles Tax Return - 2011 Page 2

ADVERTISEMENT

Reminders

Dealer In Intangibles

Am. Sub. House Bill 66 enacted by the 126

General

applicable to qualifying dealers in intangibles. Refundable

th

Assembly in 2005 clarifi ed the defi nition of a “dealer in

and nonrefundable credits may be claimed by a qualifying

intangibles” by specifying that a person must be engaged

dealer in intangibles against its dealer in intangible tax liability

primarily in the specifi c activities that distinguish dealers

for the calendar year specifi ed on the tax credit certifi cate

in intangibles from other types of business. The legislation

issued by the Venture Capital Authority. A copy of the tax

also clarifi ed the procedures whereby dealers in intangibles

credit certifi cate must be submitted at the time of fi ling. See

may petition for review of penalties, and made available the

R.C. 5725.19.

venture capital tax credit to qualifying dealers in intangibles.

Taxability of Dealers Wholly Owned By an Insurance

Explanations of these changes and the impact they have

Company or Financial Institution

in completing the dealer in intangibles tax return are listed

Anyone meeting the defi nition of a dealer in intangibles

below.

must fi le a tax return regardless if they are affi liated with an

Defi nition of “Primarily”

insurance company or fi nancial institution. All tax paid by

The tax commissioner has adopted a rule clarifying “primarily”

such entities shall be credited only to the General Revenue

as used in the defi nition of a dealer in intangibles. The

Fund. See R.C. 5725.24 and 5733.45.

defi nition has been posted on the department’s Web site.

How Commissions Are Sitused Within and Without

See Ohio Administrative Code 5703-3-32.

Ohio

Notifi cation of Dealer Status Form

In determining commissions for a broker-dealer, the billing

Effective for tax year 2006 and future years, this form is now

address shall be used to determine where the commission

required to be completed and submitted with form 980.

should be sitused. See R.C. 5725.14(C).

Clarifi cation of Procedures for Review of Penalties

“All Other Receipts” Are No Longer Considered

A penalty imposed on late-fi led returns may be abated when

When Situsing “Gross Receipts” for All Dealers

it is shown that the failure to fi le timely is due to reasonable

in Intangibles

cause. A dealer in intangibles must file a petition for

R.C. 5725.14 no longer requires that a dealer in intangibles

abatement of penalty within 60 days after the mailing of the

include 1% of all other receipts when determining gross

notice of a penalty assessment. The petition must be fi led

receipts.

with the tax commissioner, either in person or by certifi ed

Ohio Historic Preservation Tax Credit

mail. The petition shall include a true copy of the notice

Those dealers in intangibles that incur expenses in

of assessment complained of, shall indicate that the only

rehabilitating historic buildings and obtain the appropriate tax

objection is to the assessed penalty, and shall provide the

credit certifi cate are now eligible to claim a credit against their

reason for such objection. See Ohio Revised Code (R.C.)

dealer in intangibles tax liability for the calendar year specifi ed

5725.17(B) and 5711.28.

on the tax credit certifi cate issued by the Ohio Department of

Venture Capital Tax Credits for Qualifying Dealers in

Development. See R.C. 5725.151 and 149.311.

Intangibles

The existing tax credit for loans made to the program

fund administered by the Venture Capital Authority now is

- 2 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20