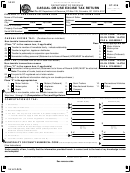

Form St-455 - State Sales, Use, Maximum Tax And Special Filers Tax Return Page 3

ADVERTISEMENT

COLUMN B - SALES AND USE TAX

WORKSHEET #3 - 5% SALES AND USE TAX

Gross Proceeds of Sales/Rentals and Withdrawals for Own Use (Enter sales

10.

Item 10.

subject to 5% tax rate requirements such as cars, trucks, airplanes and boats.)

Item 11.

Out-of-State Purchases Subject to Use Tax

11.

Item 12.

Total Gross Proceeds at 5% (Add Items 10 and 11. Enter total here and on line 1A,

Column B on front of ST-455.)

12.

Item 13.

Sales and Use Tax Allowable Deductions (Itemize by Type of Deduction and Amount of Deduction)

Type of Deduction

Amount of Deduction

a.

$

Sales over $100.00 delivered onto Catawba Reservation

$

$

$

$

$

$

<

>

Item 14.

Total Amount of Deductions (Enter total here and on line 2 of Column B on front

14.

of ST-455.)

Item 15.

Net Taxable Sales and Purchases (Item 12 minus Item 14. Enter total here and on

15.

line 3, Column B on front of ST-455.)

51623031

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3