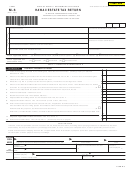

FORM M-6 (REV. 2015)

PAGE 3

Estate of

Decedent’s Social Security Number

DRF153

12. Enter the deceased spousal unused exclusion amount, if applicable. Otherwise enter zero.

If the decedent was a surviving spouse and entitled to claim the deceased spousal unused exclusion for

Hawaii Estate Tax purposes, see Instructions and check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. .

Enter name, tax identification number, and date of death of spouse whose exclusion amount is claimed as portable here:

12

13. Adjusted Applicable Exclusion Amount: Add lines 11 and 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14. Hawaii Net Taxable Estate: Line 7 minus line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15. Hawaii Estate Tax: Use the 2015 Tax Rate Schedule below, to compute the tax. If line 14 is zero

or less, enter zero here and on Schedule D, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Schedule D

TAX COMPUTATION

1.

Hawaii Estate Tax from Schedule A, line 18, Schedule B, line 15 or Schedule C, line 15 . . . . . . . . . . . . . . . . . . . . 1

2.

2

Penalty. See Instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

Interest. See Instructions (From

To

) . .

3

4.

Total Tax, Penalty, and Interest: Add lines 1, 2, and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5.

Amount paid with extension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6.

6

Balance due or (refund) (Line 4 minus line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

Amount Paid – Pay the amount due in full. Attach check or money order for full amount payable to “Hawaii State

Tax Collector.” Write the decedent’s name, social security number, and “Form M-6” on it. Pay in U.S. dollars.

Do not send cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

PART 2 - PORTABILITY OF THE DECEASED SPOUSAL UNUSED EXCLUSION (DSUE) ELECTION

DSUE amount portable to the surviving spouse. (To be completed by the estate of a decedent making a portability

election.)

1.

Deceased Spousal Unused Exclusion Election:

If Schedule A, line 12, Schedule B, line 14 or Schedule C, line 14 is less than zero, and the decedent is survived by

a spouse (including a partner in a civil union recognized in Hawaii) and the decedent is a resident of Hawaii or

nonresident of Hawaii but a U.S. resident or citizen, or if decedent is a nonresident of U.S., not U.S. citizen but are

allowed to claim a deceased spousal unused exclusion pursuant to a treaty obligation of the United States, see

Instructions and check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Enter the amount from Schedule A, line 12, Schedule B, line 14 or Schedule C, line 14 here as a positive number . .

1

2.

Deceased Spousal Unused Exclusion Election: Enter the amount shown on Part 2, line 1 or $5,430,000, whichever

is less. This is the DSUE amount portable to the surviving spouse. To elect portability of the deceased spouse

unused exclusion amount, check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2015 Tax Rate Schedule

If the amount on Schedule A, line 12, Schedule B, line 14 or Schedule C, line 14 is:

Over

But not over

the tax is:

$

0

$1,000,000

10.0%

of the net taxable estate

1,000,000

2,000,000

$100,000

plus

11.0%

of amount over

$1,000,000

2,000,000

3,000,000

210,000

plus

12.0%

of amount over

2,000,000

3,000,000

4,000,000

330,000

plus

13.0%

of amount over

3,000,000

4,000,000

5,000,000

460,000

plus

14.0%

of amount over

4,000,000

5,000,000

------------

600,000

plus

15.7%

of amount over

5,000,000

1

1 2

2 3

3