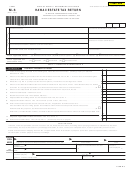

FORM M-6 (REV. 2015)

PAGE 2

Estate of

Decedent’s Social Security Number

DRF152

13. Tentative Hawaii Estate Tax: Use the 2015 Tax Rate Schedule on page 3 to compute the tax. If line 12 is zero

or less, enter zero here and on Schedule D, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14. Enter the amount of estate and/or inheritance taxes paid to other states . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15. 1.0000 minus line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

16. Multiply line 13 by line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17. Enter the smaller of line 14 or line 16 here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

18. Hawaii Estate Tax: Line 13 minus line 17. If line 18 is zero or less, enter zero here and on Schedule D, line 1 . . . . . . .

18

Schedule B

Nonresident Decedent’s Estate

1.

Value of the property included in the federal gross estate that has Hawaii situs. (Identify property on attached

federal Form 706) If decedent was a nonresident and the decedent’s state of residency has a reciprocity

agreement or statutory provision that exempts Hawaii residents from the death taxes imposed by that state, enter

. . . .

1

zero here. Enter the name of the state here

(See Instructions)

2.

Amount of the federal gross estate from the 2015 federal Form 706, Part 2, line 1. If the amount of the federal

gross estate is zero, enter zero here and on Schedule D, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3.

Divide line 1 by line 2. (Compute to four decimal places.) Result must not be larger than 1.0000 . . . . . . . . . . . . . . .

3

4.

Amount of the federal taxable estate from the 2015 federal Form 706, Part 2, line 3c. If the decedent was in a

Hawaii civil union or a recognized equivalent, see Instructions for the amount to enter and check here . . . . . .

4

5.

Amount of the state death tax deduction from the 2015 federal Form 706, Part 2, line 3b . . . . . . . . . . . . . . . . . . . . . .

5

6.

Add lines 4 and 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7.

7

Hawaii Taxable Estate: Multiply line 6 by line 3. Enter the result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

Basic Exclusion Amount: Enter $5,430,000 here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9.

Adjusted federal taxable gift from the 2015 federal Form 706, Part 2, line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10. Adjusted Exclusion Amount: Line 8 minus line 9. (If zero or less, enter zero) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11. Multiply line 10 by line 3. Enter the result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12. Enter the deceased spousal unused exclusion amount, if applicable. Otherwise enter zero.

If the decedent was a surviving spouse and entitled to claim the deceased spousal unused exclusion for

Hawaii Estate Tax purposes, see Instructions and check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Enter name, tax identification number, and date of death of spouse whose exclusion amount is claimed as portable here:

12

13. Adjusted Applicable Exclusion Amount: Add lines 11 and 12. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14. Hawaii Net Taxable Estate: Line 7 minus line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15. Hawaii Estate Tax: Use the 2015 Tax Rate Schedule on page 3 to compute the tax. If line 14 is zero or less, enter

zero here and on Schedule D, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Nonresident Alien Decedent’s Estate

Schedule C

1.

Value of the property included in the federal gross estate that has Hawaii situs. (Identify property on attached

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

federal Form 706-NA)

2.

Amount of the federal gross estate from the 2015 federal Form 706-NA, Schedule B, line 1. If the amount of the

federal gross estate is zero, enter zero here and on Schedule D, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3.

Divide line 1 by line 2. (Compute to four decimal places.) Result must not be larger than 1.0000 . . . . . . . . . . . . . . .

3

4.

Amount of the federal taxable estate from the 2015 federal Form 706-NA, Part II, line 1. If the decedent was in a

Hawaii civil union or a recognized equivalent, see Instructions for the amount to enter and check here . . . . . .

4

5.

Amount of the state death tax deduction from the 2015 federal Form 706-NA, Schedule B, line 7 . . . . . . . . . . . . . . .

5

6.

Add lines 4 and 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7.

7

Hawaii Taxable Estate: Multiply line 6 by line 3. Enter the result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

Basic Exclusion Amount: Enter $60,000 here.

If the nonresident alien was a citizen of a U.S. possession or a citizen of a country that has a death treaty with the

U.S. such that the unified credit is affected under IRC section 2102(b)(3)(A), see Instructions for the amount to

8

enter here and check here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

9

Adjusted federal taxable gift from the 2015 federal Form 706, Part 2, line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10. Adjusted Exclusion Amount: Line 8 minus line 9. (if zero or less, enter zero) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11. Multiply line 10 by line 3. Enter the result here. (Continue to line 12 on page 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

1

1 2

2 3

3