Page 2 of 11 RP-305 (3/15)

General information, filing requirements, and eligibility requirements can be found on pages 8 and 9. Instructions for the

completion of Parts 1 through 10 can be found on pages 9 through 11 of this form. All applicants must complete Parts 1 and 10.

Applicants seeking an agricultural assessment for land used to support a commercial horse boarding operation must complete Part 5.

Applicants seeking similar benefits on land used to support a commercial equine operation must complete Part 6. Applicants whose

land was rented and used in the preceding two years to produce for sale crops, livestock or livestock products, but which does not

independently satisfy the gross sales value requirement of the Agriculture and Markets Law, must complete Part 8. Applicants seeking

an agricultural assessment for land used as silvopasture must complete Part 9. Complete all other parts that apply.

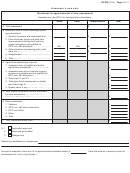

Part 1 – Use of land: Refer to Soil Group Worksheet (APD-1) to complete Part 1.

(1) Agricultural land

a. Land used to produce crops, livestock or livestock products. Amount of land actually used

Acres

to produce for sale crops, livestock or livestock products (not including woodland products) in the

preceding two years.

a.

b. Land used to support a commercial horse boarding operation. Amount of land used to support a

Acres

commercial horse boarding operation during the past two years.

b.

c. Land used to support a commercial equine operation. Amount of land used to support a

Acres

commercial equine operation during the past two years.

c.

d. Support land. Amount of land that was not used to produce crops, livestock or livestock products but

Acres

was used in support of the farm operation or in support of land used to produce crops, livestock or

livestock products. (Does not include land used under agricultural amusements - see instructions.)

d.

e. Land participating in federal conservation program. Amount of land set aside through participation

Acres

in a U.S. government conservation program established pursuant to Title 1 of the Federal Food

Security Act of 1985 or any subsequent federal program. (Assessor will need Farm Service Agency

documentation.)

e.

f. Land under a structure in which crops, livestock or livestock products are produced. Amount

Acres

of land located under a structure in which crops, livestock or livestock products have been produced

during the preceding two years.

f.

g. Land used as silvopasture. Amount of land that intentionally combines trees, forages and livestock

Acres

and is managed as a single integrated practice for the collective benefit of each, including the planting

of appropriate grasses and legume forages among trees for sound grazing and livestock husbandry,

up to the allowable limit. (Enter acreage from Part 9, Box 7(b)).

g.

Total acres in agricultural land (sum of a, b, c, d, e, f, and g)

(1)

Acres

Acres

(2) Farm woodland (up to 50 acres). Amount of land used for the production for sale of woodland products

in the preceding two years. Acreage consisting of sugarbush or Christmas tree cultivation should be

included in Part 1a above.

(2)

(3) Excess farm woodland (woodland exceeding 50 acre limit on any parcel).

(3)

Acres

Acres

(4) Newly planted orchards, vineyards, or Christmas trees of a newly-established farm operation.

(4)

(5) Nonagricultural land. Include any land in the parcel which is not included above.

(5)

Acres

Total acres in parcel (The figure entered in this box should equal the sum of the amounts entered in

Acres

boxes 1 through 5 above.)

Part 2 – Other agricultural land owned by the applicant: Identify any other land owned by the applicant that is used in conjunction

with land identified in Part 1 above to produce crops, livestock or livestock products or to support a commercial horse boarding or

commercial equine operation. Use additional sheets if necessary.

Tax Map no.

No. of acres

Location

Tax Map no.

No. of acres

Location

Tax Map no.

No. of acres

Location

Part 3 – Other agricultural property rented by applicant: Identify any other land rented from another and used to produce crops,

livestock or livestock products in conjunction with the land described in Part 1 above. Use additional sheets if necessary.

Tax Map no.

No. of acres

Location

Tax Map no.

No. of acres

Location

Tax Map no.

No. of acres

Location

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11