RP-305 (3/15) Page 9 of 11

(F) The land used in agricultural production consists of

of ownership that receives $10,000 or more in gross

at least seven acres, is owned or rented by a newly

receipts annually from fees generated through 1) the

established farm operation, and is used solely for

provisions of commercial equine activities including

the production for sale of orchard or vineyard crops

but not limited to riding lessons, trail riding activities or

or Christmas trees. Such land may be eligible for an

training horses (but not horse racing), 2) production for

agricultural assessment, not-withstanding the fact that

the sale of crops, livestock and livestock products, or

the new orchard or vineyard does not produce crops for

through both 1 and 2. An otherwise eligible operation

sale for four years after planting or the Christmas trees

proposed in its first or second year of operation may

are not harvested for sale for five years after planting.

qualify as a commercial operation if it consists of at least

seven acres and stables at least ten horses, regardless

or

of ownership, by the end of the first year of operation.

(G) The land used in agricultural production supports an

apiary products operation, is owned by the operation,

2. Agricultural land rented to another and used during the

and consists of not less than seven and not more than

preceding two years to produce for sale crops, livestock or

ten acres with an average gross sales value of $10,000

livestock products, but which does not independently satisfy

or more, or comprises less than seven acres with an

the gross sales value of the Agriculture and Markets Law,

average gross sales value of $50,000 or more.

may nevertheless be eligible for an agricultural assessment, if

the following conditions are satisfied:

or

– The land must consist of at least seven acres and be used

(H) Rented land located within an agricultural district used

as part of a single operation to produce crops, livestock or

by a not for profit institution for agricultural research

livestock products (exclusive of woodland products) in the

intended to improve the quality or quantity of crops,

preceding two years;

livestock or livestock products.

– The land must currently be used to produce crops,

or

livestock or livestock products (exclusive of woodland

(I)

The land consists of at least seven acres and has

products) under a written rental arrangement of five or

been used during the preceding two years to support

more years; and

a commercial equine operation with annual receipts

– The land must be used in conjunction with other land

of $10,000 or more. A commercial equine operation is

which qualifies for an agricultural assessment.

defined as an agricultural enterprise consisting of at least

seven acres and stabling at least ten horses, regardless

Instructions for applicant

by an apiary products operation between the operation and

For Questions on page 2

adjacent landowners. (The total area of an apiary products

operation, including support land, may not exceed ten acres.

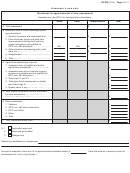

Part 1 – Use of Land

(Support land does not include land used under agricultural

For Part 1, the data from the Soil group worksheet (APD-1)

amusements.)

should be used. Further breakdowns of the (1) Agricultural

land category by land use should be shown in 1a through 1f

(1) e. Land participating in a federal conservation program.

explained below.

Amount of land set aside through participation in a U.S.

government conservation program established pursuant

(1) a. Land actually used to produce crops, livestock or

to Title 1 of the Federal Food Security Act of 1985 or any

livestock products may include cropland, muck, orchards,

subsequent federal program.

vineyards and pasture. For this purpose crops, livestock and

livestock products include, but are not limited to, the following:

(1) f. Land under a structure in which crops, livestock or

field crops, fruits, vegetables, horticultural specialties, Christmas

livestock products are produced. Amount of land located

trees, cattle, horses, poultry, ratites, wool bearing animals such

under a structure in which crops, livestock or livestock products

as alpacas and llamas, milk, eggs, furs, maple sap or syrup,

have been produced during the preceding two years.

honey, beeswax, royal jelly, bee pollen, propolis, package bees,

nucs, queens, aquacultural products and woody biomass.

(1) g. Land used as silvopasture. Amount of land used as

silvopasture, but not more than the acreage limit (from Part 9,

(1) b. Land used to support a commercial horse boarding

Box 7(b)).

operation. Amount of land used to support a commercial horse

boarding operation during the past two years.

(1) Agricultural land – total from Soil group worksheet.

(1) c. Land used to support a commercial equine operation.

(2) Farm woodland means land, primarily used for the

Amount of land used to support a commercial equine operation

production for sale of woodland products (logs, lumber, posts,

during the past two years.

firewood, etc.), where such land is used as a single operation

and is contiguous with cropland, orchards, vineyards or land

(1) d. Support land may include farm ponds, swamps used

used to pasture livestock. Lands divided by state, county or

for drainage, land used for erosion control, hedgerows,

town roads, railroads or energy transmission corridors will be

access roads, land under farm buildings, dikes and levies

considered contiguous. Farm woodland does not include land

used for flood protection, drainage ditches and land used for

used as silvopasture as long as the silvopasture acreage lmit

farm waste management. Support land may also include any

is not exceeded (see Part 9), but if there is any silvopasture

other minor acreage that is located amid, between or on the

acreage over the limit, the excess acreage should be treated

perimeter of cropland, orchards, vineyards and land used to

as farm woodland. Woodland acreage exceeding 50 acres on

pasture livestock, so long as the land is not farm woodland or

any parcel should be in Part 1 (3), Excess farm woodland. Enter

nonagricultural land (see instructions below for line 1e). Support

number of acres from section D2 of the Soil group worksheet.

land further may include a buffer area owned and maintained

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11