RP-305 (3/15) Page 3 of 11

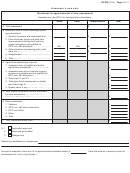

Part 4 – Average gross sales value

Note: Newly established farm operations should enter annual gross sales only for the first or second year of production.

Year One Year Two

a. Enter the gross sales value of any agricultural products (not including woodland products)

produced for sale in the preceding two years on land owned by the applicant (see Part 1a and

Part 2.) For land rented by the applicant from another, see Part 3. (If applicable, include federal

farm program payments.)

a $

$

b. Enter the gross sales value up to a maximum annual amount of $2,000 of any woodland products

produced for sale in the preceding two years on land owned by the applicant; see Part 1(2) and

Part 2. Note: The gross sales value of maple syrup/sap and Christmas trees produced on the

applicant’s land should be included in Part 4a above.

b $

$

c. Enter the market value of crops in their unprocessed state that were produced during the preceding

two years on land owned by the applicant or rented by the applicant from another which were not

sold unprocessed but were processed on the farm to make other products and thereafter sold.

c $

$

d. Enter the gross sales value up to a maximum of $5,000 of the farm operation’s annual gross sales

value derived from the operation’s sale of its compost, mulch, or other organic biomass crops.

d $

$

Total gross sales value for two year period

$

$

Two year average gross sales value

$

$

Part 5 – Land used to support a commercial horse boarding operation

a) Number of acres in a parcel used to support a horse boarding operation:

acres.

(

If the number of acres is less than seven, Part 2 above must be completed to establish eligibility for an agricultural assessment.

(b) Did the boarding operation board ten or more horses throughout the preceding two years?

Yes

No

(c) Gross receipts collected by horse boarding operation during the preceding two years: $

Note: Newly established farm operations should enter annual gross sales only for the first or second year of production.

Year One

Year Two

Fees generated through boarding of horses

$

$

Fees generated through production of sale of crops, livestock and livestock products

$

$

Totals

$

$

Part 6 – Land used to support a commercial equine operation

a) Number of acres in a parcel used to support an equine operation:

acres.

(

If the number of acres is less than seven, Part 2 above must be completed to establish eligibility for an agricultural assessment.

(b) Did the equine operation stable ten or more horses throughout the preceding two years?

Yes

No

(c) Gross receipts collected by equine operations during the preceding two years: $

Note: Newly established farm operations should enter annual gross sales only for the first or second year of production.

Year One

Year Two

Fees generated through equine operations

$

$

Fees generated through production of sale of crops, livestock and livestock products

$

$

Totals

$

$

Part 7 – Land under a structure within which crops, livestock or livestock products are produced

Note: Newly established farm operations should enter annual gross sales only for the first or second year of production.

Year One

Year Two

(a) Gross sales value of the crops, livestock or livestock products produced in the

structure(s) in the preceding two years

(b) $

(c) $

(d) Total gross sales value for two year period: (b) + (c)

(d) $

(e) Average gross sales value for preceding two years: (d / 2)

(e) $

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11