RP-305 (3/15) Page 7 of 11

Assessor’s use only

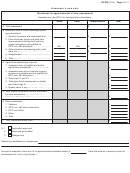

Worksheet for apportionment of farm assessment

Assessor may use RPS 4 to complete these calculations.

Acres

Land

Improvements

Total

A. Total assessment

$

$

$

B. Assessed value of parcel excluding eligible

agricultural land

1. Owner’s residence and associated land .........

$

$

$

2. Farm structures (barns and other farm

improvements including fruit tree/vine

support structures) not qualified for

N/A

N/A

RPTL sec. 483 exemption ...............................

$

$

3. Other structures (processing plant, retail

store, etc.) .......................................................

$

$

4. Ineligible land

(include excess woodland acreage)

$

$

5. Total

..............................

(add lines 1, 2, 3 and 4)

$

C. Agricultural assessment of parcel

1. Assessed value of eligible land before

agricultural assessment

...

(line A minus line B5)

$

2. Assessed value of fruit tree/vine support

structures on eligible land not qualified for

RPTL sec. 483 exemption ...............................

$

3. Total lines C1 and C2 .....................................

$

4. Total agricultural assessment on eligible

land (from page 4) ..........................................

$

5. Excess value, if any

...........

(line 3 minus line 4)

$

D. Total taxable assessment before adjustment

for other exemptions

(line B5 plus line C1 or

................................

B5 plus C4, whichever is lower)

$

E. Other exemptions

1. Veterans

$

2. RPTL sec. 483 new construction

$

3. RPTL sec 483-a

$

4. Other

$

5. Total

$

F. Total taxable assessed value

(line D minus line E5)

$

G. 1.

Application approved

2.

Approved as modified

3.

Disapproved

Reason for modification or disapproval

Amount of exemption (from line C5 of apportionment worksheet above): $

Enter this amount in exempt column of

assessment roll, and on top of page 1.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11