Page 4 of 10 RP-305 (3/15)

Page 4 of 11 RP-305 (3/15)

Notice to applicant

By filing this application, the landowner agrees that the lands that benefit from agricultural assessment will be liable for payment

whenever the land is converted to a non-agricultural use. The consequence of a conversion is a payment based on five times the taxes

saved in the most recent year of benefit. The payment also includes a six percent interest charge, compounded annually for each year

during the last five, in which the land received an agricultural assessment. An encumbrance runs with the land from the last time the

parcel benefitted for five years in an agricultural district, and for eight years outside a district. (For land outside an agricultural district,

the obligation to make payment for a conversion creates a lien against the entire parcel, even if only a portion of the parcel benefitted

from agricultural assessment.)

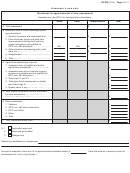

Part 8 – Land rented to others

a) Is any portion of the parcel rented to another party?

Yes

No

(

(If No, proceed to Part 9.)

(b) Has the land been used during the preceding two years to produce crops, livestock or livestock

products exclusive of woodland products and is such production continuing during the current year?

Yes

No

(c) Average gross sales value: $

Note: Newly-established farm operations should enter annual gross sales only for the first or second year of production.

Year One

Year Two

1. Gross sales value of the crops, livestock or livestock products

(exclusive of woodland products) produced on the rented land that

can be independently verified

(1a) $

(1b) $

2. Total gross sales value for two year period: (1a) + (1b)

(2) $

3. Average gross sales value for preceding two years: (2) / 2

(3) $

If the amount on line 3 is less than $10,000 or cannot be independently verified, complete items d, e, f, and g of Part 8 below.

(d) Name and mailing address of party to whole land is rented:

(e) Number of acres rented to party identified in Part 8d and used in agricultural production:

acres

(f)

Is the land leased pursuant to a written rental arrangement?

Yes

No

Period of time for which lease is in effect:

years

Attach a copy of the lease or an affidavit (Form RP-305-c) attesting to the existence of the lease.

(g) Does the party to whom the land is rented own or operate other land that is used in

conjunction with this rented land and which qualifies for an agricultural assessment?

Yes

No

If Yes, provide the following information for the other land being used in conjunction with the land that is the subject of this

application.

Owner

Location of property

Tax Map no.

If the other land is located in a different town or assessing unit, enter the date that an application for an agricultural assessment

was submitted to the local assessor:

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11