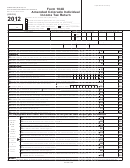

Departmental Use Only

DR 0104X (10/02/14)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0005

(0015)

Form 104X Amended

2014

Colorado Individual Income

*140104X=19999*

Tax Return

Reason for amended return (mark one)

From tax year ending

(YYYY)

Investment credit carryback

Other, attach explanation

From tax year ending

(YYYY)

Federal net operating loss carryback

Changing filing status

From tax year ending

(YYYY)

Federal net capital loss carryback

Changing residency status

Protective claim, attach explanation

Last Name

First Name

Date of Birth

SSN

Middle

Deceased

(MM/DD/YY)

Initial

Yes

Spouse’s Last Name, if joint

First Name

Date of Birth

SSN

Middle

Deceased

(MM/DD/YY)

Initial

Yes

Telephone Number

Mailing Address

(

)

City

State

Zip

Foreign Country (if applicable)

As Amended

1. Enter Federal Taxable Income from 1040EZ line 6, 1040A line 27, 1040 line 43

or 1040X line 5

1

00

Additions

2. State Addback, enter the state income tax deduction from your federal form

1040 schedule A, line 5 (see instructions)

2

00

3. Other additions, explain (see instructions)

3

00

4. Subtotal, add lines 1 through 3

4

00

Subtractions

5. State Income Tax Refund from federal income tax form: enter $0 filing 1040EZ

or 1040A; 1040 line 10.

5

00

Staple W-2s and 1099s here.

6. U.S. Government Interest

Use only for line 27.

6

00

7. Primary Taxpayer Pension/Annuity Income

Deceased SSN:

7

00

8. Spouse Pension/Annuity Income

Deceased SSN:

8

00

9. Colorado Source Capital Gain; 5-year assets acquired on or after 5/9/1994

9

00

Total Contribution

10. Tuition Program Contributions (see instructions)

$

Owner’s Name

Owner’s SSN:

10

00

1

1 2

2 3

3 4

4