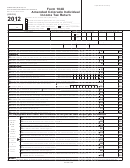

*140104X=29999*

Total Contributions

11. Qualifying Charitable Contribution

11

$

00

12. Qualified Reservation Income

12

00

13. PERA/DPSRS Subtractions, for PERA contributions made in 1984-1986 or

DPSRS contributions made in 1986.

13

00

14. Railroad Benefit Subtraction, tier I or II only

14

00

15. Wildfire Mitigation Measures Subtraction

15

00

16. Colorado Marijuana Business Deduction

16

00

Explain

17. Other Subtractions (see instructions)

17

00

18. Subtotal, add lines 5 through 17

18

00

19. Colorado Taxable Income, line 4 minus line 18

19

00

Tax, Prepayments and Credits: see 104 Booklet for full-year tax table and part-year PN Schedule

20. Colorado Tax from tax table or 104PN line 36 (attach 104PN, if applicable)

20

00

21. Alternative Minimum Tax from Form 104AMT

21

00

22. Recapture of prior year credits

22

00

23. Subtotal, add lines 20 through 22

23

00

24. Nonrefundable Credits from 104CR line 33, cannot exceed the sum

of lines 20 and 21

24

00

25. Total Enterprise Zone credits used – as calculated, or form DR 1366 line 77

25

00

26. Net Tax, subtract lines 24 and 25 from line 23

26

00

CO Income Tax Withheld from W-2s and 1099s. Staple to front page only if

27.

27

line 27 is greater than $0

00

28. Prior-year Estimated Tax Carryforward

28

00

29. Estimated Tax Payments, enter the sum of the quarterly payments remitted for

29

this tax year

00

30. Extension Payment remitted with form 158-I

30

00

31. Other Prepayments:

104BEP

DR 0108

DR 1079

31

00

32. Innovative Motor Vehicle Credit from line 27 form DR 0617

32

00

33. Refundable Credits from 104CR line 3

33

00

34. Subtotal, add lines 27 through 33

34

00

Federal Adjusted Gross Income from your federal income tax form: 1040EZ

35.

line 4; 1040A line 21; 1040 line 37

35

00

If you want the Department of Revenue to compute and mail your refund, or compute your balance due and mail a bill, stop here and

leave lines 36 through 51 blank. If you want to compute the refund or balance due yourself, continue with line 36.

36. Overpayment, if line 34 is greater than 26 then subtract line 26 from

line 34

36

00

1

1 2

2 3

3 4

4