*140104X=39999*

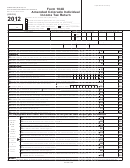

37. Enter the overpayment from your original return or as previously adjusted

37

00

38. If line 26 is larger than line 34, enter the amount owed

38

00

39. Enter the amount owed from your original return or as previously adjusted

39

00

Compute the Amount Owed

40. Line 37 minus line 36, but not less then zero

40

00

41. Line 38 minus line 39, but not less than zero

41

00

42. Additional tax due, total of lines 40 and 41

42

00

43. Interest due on additional tax

43

00

44. Penalty due

44

00

45. Estimated tax penalty due

45

00

Paid by EFT

46. Payment due with this return, add lines 42 through 45

46

00

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same day received by the State. If converted, your

check will not be returned. If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount directly from your bank account

electronically.

Pay online at

We strongly recommend that you file using Revenue Online. If you cannot efile, you may mail it to:

Colorado Department of Revenue, Denver, CO 80261-0005

Compute the Refund

47. Line 36 minus line 37, but not less than zero

47

00

48. Line 39 minus line 38, but not less than zero

48

00

49. Overpayment, total of lines 47 and 48

49

00

50. Amount you want credited to 2015 estimated tax.

50

00

51. Refund claimed with this return, line 49 minus line 50

51

00

File using Revenue Online and enter Direct Deposit information to get your refund in half the time!

Direct

Type:

Checking

Routing Number

Savings

CollegeInvest 529

Deposit

For questions regarding CollegeInvest direct

Account Number

deposit or to open an account call

800-448-2424 or visit

Sign your return

Under penalties of perjury, I declare that to the best of my knowledge and belief, this return is true, correct and complete.

Your Signature

Date

(MM/DD/YY)

Spouse’s Signature. If joint return, both must sign

Date

(MM/DD/YY)

Paid Preparer’s Last Name

First Name

Middle Initial

Paid Preparer’s Address

Phone Number

(

)

City

State

Zip

1

1 2

2 3

3 4

4