Form Ct-32 - Banking Corporation Franchise Tax Return - 2014 Page 10

ADVERTISEMENT

CT-32 (2014) Page 9 of 10

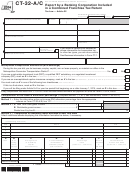

Computation of the issuer’s allocation percentage — Complete Method 1, 2, or 3

(see instructions)

Method 1 — Enter the alternative ENI allocation percentage from

%

line 137

..............................................................................................

(enter here and on line 21)

Method 2 — A New York State gross income ................................................... $

B Worldwide gross income ........................................................... $

%

Divide line A by line B

................................................................................................

(enter here and on line 21)

Method 3 — Computation of subsidiary capital allocated to New York State — Attach separate sheets displaying this information

formatted as below, if necessary.

A — Description of subsidiary capital (list the name of each corporation and the EIN here; for each corporation, complete columns B through G on

the corresponding lines below; see instructions)

Item

Name

EIN

A

B

C

D

E

F

G

A

B

C

D

E

F

G

Item

Voting

Average value

Current liabilities

Net average

Issuer’s

Value allocated

stock

of subsidiary

attributable to

value

allocation

to New York State

owned

capital

subsidiary capital

%

(col. C – col. D)

(col. E × col. F)

%

(see instructions)

(see instructions)

(see instr.)

A

B

C

D

E

F

G

Amounts from attached list

168 Totals ....................................................................................... 168

Method 3 — Computation of business capital allocated to New York State

169 Average value of total assets from line 70 ...................................................................................... 169

170 Current liabilities

................................................. 170

(see instructions)

171 Total net average value of subsidiary capital from line 168, column E 171

172 Net business assets

........................................................... 172

(subtract lines 170 and 171 from line 169)

173 Enter the alternative ENI allocation percentage from line 137 ....................................................... 173

%

174 Business assets allocated to New York State

...................................... 174

(multiply line 172 by line 173)

Method 3 — Computation of issuer’s allocation percentage

175 Subsidiary capital and business capital allocated to New York State

.... 175

(add line 168, column G and line 174)

176 Total worldwide capital

.......................................................................................... 176

(see instructions)

177 Issuer’s allocation percentage

.........................

%

(divide line 175 by line 176; enter here and on line 21)

177

420009140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11