Form Ct-32 - Banking Corporation Franchise Tax Return - 2014 Page 5

ADVERTISEMENT

Page 4 of 10 CT-32 (2014)

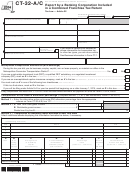

Schedule D — Computation of taxable assets and tax rate

(see instructions)

70 Average value of total assets

................................................................................

70

(see instructions)

71 Money or other property received from the FDIC, FSLIC, or RTC

.......................

71

(see instructions)

72 Taxable assets

...................................................................................... 72

(subtract line 71 from line 70)

73 Allocated taxable assets:

%

(multiply line 72 by

from line 161 or line 153;

...................................................................................

73

enter here and on Schedule A, next to line 3)

Net worth on last day of the tax year

74 Compute net worth ratio

:

(see instructions)

=

Total assets on last day of the tax year

............. 74

%

Average quarterly balance of mortgages =

75 Compute percentage of mortgages

Average quarterly balance of total assets

......... 75

%

included in total assets

:

(see instructions)

Tax rates

Use the chart below to determine your tax rate. This rate must be used to compute the alternative minimum tax

measured by taxable assets. You must meet both the net worth ratio and percentage of mortgages included in the

total assets requirements to qualify for the lower tax rates.

Mark an X in the appropriate box in the last column and use this rate on line 3.

If the net worth ratio

And the % of mortgages

The

Indicate the

(from line 74) is:

included in total assets

tax

appropriate

(from line 75) is:

rate is:

rate

Less than 4%

33% or more

.00002

At least 4% but less than 5%

33% or more

.00004

All others

All others

.0001

Schedule E — Depreciation on certain property when method differs from federal

(see instructions)

Part 1 — Depreciation on qualified New York property acquired between January 1, 1964, and December 31, 1967

(list each property

and the date acquired here; for each property, complete columns C through H on the corresponding lines below; see instructions)

A

B

Item

Description of property

Date acquired

A

B

C

D

E

C

D

E

F

G

H

Item

Cost

Federal depreciation

Federal depreciation

New York depreciation New York depreciation

Undepreciated

prior years

this year

prior years

this year

balance

A

B

C

D

E

Totals

76 Add column E amounts

Combine this total with line 78, and enter on line 28.

77 Add column G amounts

Combine this total with line 82, and enter on line 60.

420004140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11