Form Ct-32 - Banking Corporation Franchise Tax Return - 2014 Page 9

ADVERTISEMENT

Page 8 of 10 CT-32 (2014)

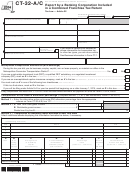

Part 3 — Computation of taxable assets allocation

Include all activities of an IBF in both the numerator (column A) and

A

B

denominator (column B) when computing the taxable asset allocation

New York State

Everywhere

138 Wages, salaries, and other compensation of employees (except

general executive officers) ............................................................... 138

139 Multiply line 138, column A, by 80% (.8) ...........................................

139

140 Percentage in New York

.... 140

%

(divide line 139, column A, by line 138, column B)

Receipts during the tax period from:

141 Interest income from loans and financing leases ..............................

141

142 Other income from loans and financing leases .................................

142

143 Lease transactions and rents ............................................................

143

144 Interest from bank, credit, travel, entertainment, and other credit

144

card receivables ............................................................................

145 Service charges and fees from bank, credit, travel, entertainment,

and other credit cards ...................................................................

145

146 Receipts from merchant discounts....................................................

146

147 Income from trading activities and investment activities ..................

147

148 Fees or charges from letters of credit, traveler’s checks, and money orders ...

148

149 Performance of services ....................................................................

149

150 Royalties ............................................................................................

150

151 All other business receipts ................................................................

151

152 Total

...........................................................

152

(add lines 141 through 151)

153 Percentage in New York

............................................. 153

%

(see instructions)

154 Additional receipts factor

...................... 154

%

(enter percentage from line 153)

Deposits maintained in branches

155 Deposits of $100,000 or more ...........................................................

155

156 Deposits of less than $100,000 .........................................................

156

157 Add lines 155 and 156 .......................................................................

157

158 Percentage in New York

.... 158

%

(divide line 157, column A, by line 157, column B)

159 Additional deposits factor

..................... 159

%

(enter percentage from line 158)

160 Total of New York percentages

.... 160

%

(add lines 140, 153, 154, 158, and 159)

161 Taxable assets allocation percentage

......................... 161

%

(see instructions)

Composition of prepayments on Schedule A, line 10

(see instructions)

Date paid

Amount

162 Mandatory first installment .................................................................................

162

163a Second installment from Form CT-400 ............................................................... 163a

163b Third installment from Form CT-400 ................................................................... 163b

163c Fourth installment from Form CT-400 ................................................................. 163c

164 Payment with extension request from Form CT-5, line 5 ................................... 164

165 Overpayment credited from prior years

................................................................. 165

(see instructions)

166 Overpayment credited from Form CT-32-M ................................................................................... 166

167 Total prepayments

............................................. 167

(add lines 162 through 166; enter here and on line 10)

420008140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11