Form Ct-3-B - Tax-Exempt Domestic International Sales Corporation (Disc) Information Return - 2013 Page 2

ADVERTISEMENT

Page 2 of 6 CT-3-B (2013)

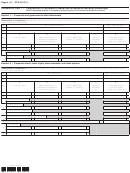

A

B

C

Computation of capital

Beginning of year

End of year

Average value

26 Total assets from federal return ..................... 26

27 Real property and marketable securities

included on line 26 ..................................... 27

28 Subtract line 27 from line 26 .......................... 28

29 Real property and marketable securities at

fair market value ......................................... 29

30 Adjusted total assets

....... 30

(add lines 28 and 29)

31 Total liabilities ................................................. 31

32 Total capital

.....................................................................

32

(subtract line 31, column C, from line 30, column C)

33 Subsidiary capital

................................................................................................

33

(from Schedule C, line 28)

34 Business and investment capital

....................................................................

34

(subtract line 33 from line 32)

35 Investment capital

..................................................................................

35

(from Schedule B, line 7, column E)

36 Business capital

..............................................................................................

(subtract line 35 from line 34)

36

Computation of minimum taxable income (MTI)

42 ENI from page 1, line 17 ...........................................................................................................................

42

Adjustments

43 Depreciation of tangible property placed in service after 1986 ................................................................

43

44 Amortization of mining exploration and development costs paid or incurred after 1986 .........................

44

45 Amortization of circulation expenditures paid or incurred after 1986

.....

45

(personal holding companies only)

46 Basis adjustments in determining gain or loss from sale or exchange of property ..................................

46

47 Long-term contracts entered into after February 28, 1986 ......................................................................

47

48 Installment sales of certain property .........................................................................................................

48

49 Merchant marine capital construction funds ............................................................................................

49

50 Passive activity loss

.......................................................

50

(closely held and personal service corporations only)

51 Add lines 42 through 50 ............................................................................................................................

51

Tax preference items

52 Depletion ...................................................................................................................................................

52

53

54 Intangible drilling costs .............................................................................................................................

54

55 Add lines 51 through 54 ............................................................................................................................

55

56 New York NOLD from page 1, line 13 .......................................................................................................

56

57 Add lines 55 and 56 ..................................................................................................................................

57

58 Alternative net operating loss deduction (ANOLD) ...................................................................................

58

59 MTI

..................................................................................................................

59

(subtract line 58 from line 57)

60 Investment income before apportioned NOLD

...............................

60

(add page 1, line 18 and page 5, line 21)

61 Investment income not included in ENI but included in MTI ....................................................................

61

62 Investment income before apportioned ANOLD

........................................................

62

(add lines 60 and 61)

63 Apportioned New York ANOLD ................................................................................................................

63

64 Alternative investment income before allocation

............................................

64

(subtract line 63 from line 62)

65 Alternative business income before allocation

...............................................

65

(subtract line 64 from line 59)

(continued)

474002130094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6